Inside Connected Health: Top 10 Technology Trends

By Cory Forbes, Chief Technology Officer, Nypro, A Jabil Company

First seen on Jabil’s Insight blog

Connectivity is pervading every aspect of our lives: offices, homes, commercial spaces and even cars. As this intoxicating technology nestles into new devices, the efficiency and productivity gains become undeniable. But connectivity in one industry can truly change how we live: healthcare.

More than 250,000 people in the U.S. die every year due to physician error, the third leading cause of death after heart disease and cancer, according to a recent study by Johns Hopkins. The promise of data-driven connectivity could minimize human error and lead to a remarkably better healthcare system worldwide.

Still, there is plenty of work to do before a future with connected health becomes reality. Jabil recently partnered with Dimensional Research to survey more than 200 business decision makers in connected healthcare solutions to explore the current state of the connected health industry and where it is headed. Download the full Connected Health Technology Trends Report.

As part of the 2018 Connected Health Technology Trends survey, the term “connected healthcare solutions” refers to healthcare products and devices that utilize the Internet of Things (IoT) technology to enable remote management, collect and report data or alert on usage. This includes—but is not limited to—items such as smart pill bottles, remote health monitoring and diagnostics, fitness trackers and connected care delivery systems. It does not include health tracking apps where data is entered manually.

Here are the top 10 connected health technology trends from the research study:

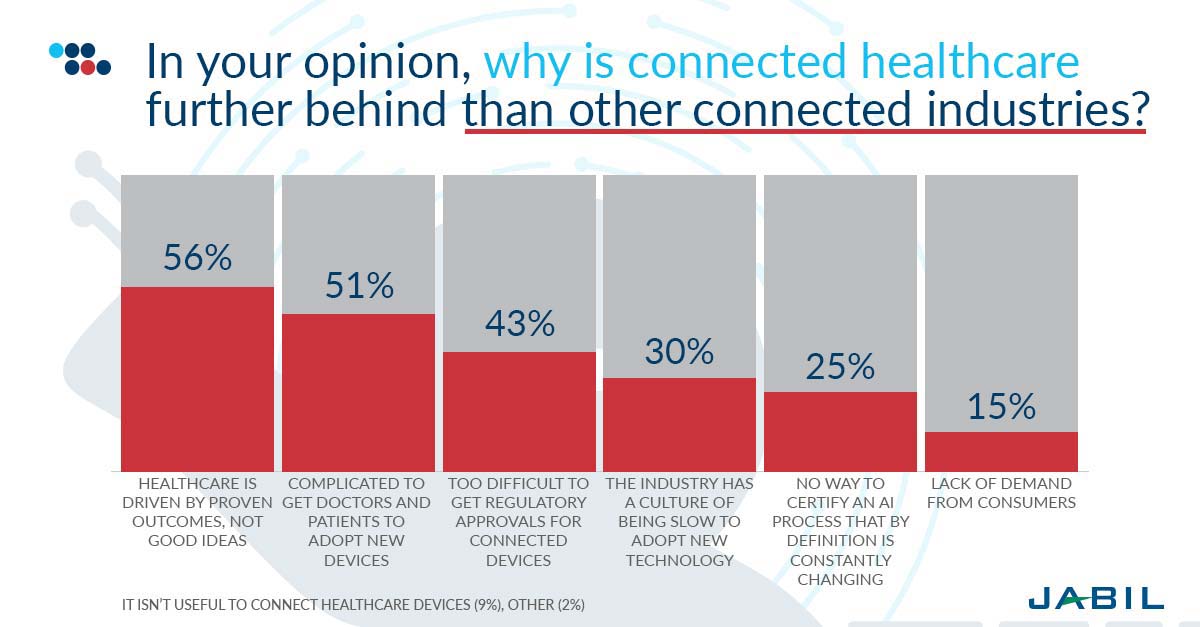

Connected Health Lags Other Industries

A rising number of devices—ranging from kitchen utensils to toys—are gaining connectivity features every day. By 2030, IHS estimates that 125 billion devices will have IoT capabilities. While connected health may contribute to this growth, it has lagged most other connected sectors up to this point. There are several reasons for this.

Most notably, respondents believe this sluggishness reflects a healthcare product industry whose customers demand proven outcomes – not just good ideas. If a toy manufacturer wants to add connectivity features to its product, it is much simpler in comparison to healthcare, which must navigate a tangle of approval processes. Other reasons for the slow progress in connected health include complications in convincing both doctors and patients to adopt a new device and difficulties in obtaining regulatory approvals for anything that collects healthcare data.

Will connected health ever catch up to other industries? That remains to be seen. Connected healthcare has a lot of perfecting and maturing to do with the technology and it may help to take a page out of the automotive industry playbook. Like automotive, connected healthcare solutions must bring value to all stakeholders to ensure success. Automotive has been leading the charge in technology advances, and our lives are also heavily dependent on transportation. Therefore, if automotive continues to lead at the pace it currently does, there may be a chance for healthcare to speed up.

In September 2017, the U.S. Food and Drug Administration (FDA) selected nine companies to participate in developing a digital health software pre-certification program, including Apple, Fitbit, Johnson & Johnson, Pear Therapeutics, Phosphorus, Roche, Samsung, Tidepool and Verily. The program is built to transform the “regulatory model to assess the safety and effectiveness of software technologies, without inhibiting patient access to these technologies,” according to the FDA. With this diverse set of companies entering healthcare, there is opportunity for disruption in the industry.

Wide Range of Connected Healthcare Solutions are Possible

The potential types of connected healthcare devices are as diverse as medical conditions and treatment options. Some connected solutions aim to give patients more control over their health, while others are designed to improve health facility operations. Naturally, some of these solutions will be more useful and easily applied than others.

Although there are plenty of opportunities in all device categories, nearly half of survey participants saw on-body devices—such as fitness trackers, external monitors and similar solutions—as an eventual product type their companies may develop. Consumers are already familiar with these devices, making adoption much easier. Respondents found the next largest opportunities to be in machine-to-machine communication, which can be used to enable more devices and applications, and environment monitoring. Participants were able to select as many of these solutions as they found relevant, even if they weren’t actively working toward them now.

Respondents were then asked to pick their top priority from the categories they planned to eventually develop. One in four picked machine-to-machine communication, making it the top choice, followed closely by on-body devices. When respondents were prioritizing, in-body devices, such as pace makers, rose to fourth place. This could be an early indication of interesting moves in the connected health space. It makes sense, too, as the healthcare journey evolves to go from a lab to a point-of-care and to the home from there. Eventually, these devices will evolve to be part of us, rather than around us.

Connectivity is Making Progress in Healthcare

Given the significant potential for connected health to save and improve lives, all survey participants affirmed their interest in connecting their solutions. While connectivity offers obvious benefits to patients, solution providers can also unravel benefits to further their businesses. However, while the desire for progress is strong, the process itself is slow.

One in three participants said they were in the design phase of their development of connected healthcare solutions, while 3 percent have made it to the certification phase. Another 21 percent said they were already in production.

When asked about the status of their healthcare solution delivery to customers, 79 percent of participants affirmed that they have put a product into users’ hands, though most were only offering it to customers in a prototype stage. Only 16 percent said their products were fully launched to their users, another indication that solution providers in healthcare are behind. In addition, there isn’t enough data to explore how fully launched products are contributing to the bottom line. From my perspective, the profitable monetization of these solutions will be a key challenge as healthcare manufacturers navigate this market.

The Next Few Years Should be Interesting

Considering the wide range of possible solutions, it makes sense that healthcare product development timelines vary greatly. While most participants predicted that their average development and launch cycles would last from 12 to 36 months, 14 percent said their timelines would be more than 36 months.

Company size and product type make a difference in product development cycles. Smaller healthcare manufacturers are more likely to have cycles that are less than 12 months, whereas larger organizations tend to trail them by nearly six months. Looking at the various types of products, the development cycles for in-body devices require much more time than other product categories like machine-to-machine communication, environment monitoring and on-body devices. In-body devices would require more testing, certification and regulations as well.

The results indicate that the next three years in connected health should be exciting to watch unfold, as 55 percent of respondents expect to fully launch their connected health solutions within three years.

What is motivating healthcare manufacturers to overcome the significant challenges in connected solutions? More than half say they are interested in delivering innovative new products and services, while 44 percent would like to enable new business models. But why should healthcare manufacturers consider connectivity in the first place? Respondents indicated the largest benefits of connected healthcare include better treatment of illnesses, early detection of symptoms and tracking patient behaviors to lead to better outcomes.

Manufacturing Challenges Abound

Ninety-five percent of participants indicated facing manufacturing challenges in developing their connected health solutions, though only 17 percent found it to be the most difficult problem. More than half of healthcare manufacturers (57 percent) said they need enabling technologies to evolve to put them on the right track toward their goals. Another 44 percent noted that manufacturing costs are too high. As connectivity becomes a consideration for all healthcare devices, the price of manufacturing may come as a surprise to some. For example, solutions like auto injectors and inhalers were cheap and had no electronics in the past, however, adding connectivity comes at a price. The cost rises relatively to add in electronics and the surrounding cloud support infrastructure.

One in four mentioned that they are struggling with electronic component shortages. There hasn’t been a need for healthcare products to be redesigned at a pace consistent with technology in the past, but the concept of connectivity is changing that. It’s time for healthcare to experience a technology revolution.

As my colleague, Joe McBeth, vice president of supply chain at Nypro, explains, component shortages are not a new challenge for the healthcare industry. In the past, solution providers simply opted to pay higher premiums for parts or buy and hold them on their balance sheets. Today, however, “healthcare manufacturers must drive a cultural change to include speed and technology as major drivers to their product strategies,” McBeth writes.

Majority Report Issues with User Adoption

More than half said that users are concerned (rightfully so) about privacy and security. This issue is not specific to the healthcare industry, but it has more prevalent implications when the data includes some of patients’ most personal and sensitive information.

As with any connected device, there can be concerns around data security. For example, a body patch that delivers insulin could potentially be hacked by someone with malicious intent. Therefore, whether you’re manufacturing the product yourself or working with a third-party, you must integrate security best practices in all your devices. Knowing that you’re putting their well-being (in more than just health) first can develop trust with patients and care providers. Regardless, data security will and should be an ongoing discussion for your connected solutions.

With the recent media focus on data security and privacy, consumers are on edge. In Jabil’s recent Connected Home and Building Technology Trends survey, 69 percent of solution providers said the recent focus on these issues made them rethink their plans to collect and use data generated from their devices. Consumers are concerned that their data, whether housed in the cloud or on a device, will be shared to third parties or used to advertise other products to them. In healthcare, however, HIPAA serves as a reassurance that data security will be key.

Ease of use presents another issue. Healthcare products typically require training and education for proper use. When connectivity features are added, these products could become even more complicated. Imagine the trouble you go through just to set up or troubleshoot a smart speaker in your home. That image of puzzling over the instruction manual gives us a clear indication of why ease of use is essential for healthcare products.

As connectivity evolves through new technologies such as narrowband IoT and LTE-M, this new model will eliminate the complications of setting up connected devices after purchase. Solution providers will be able to configure their products at an OEM level and decrease connectivity costs. Long behind will be the days of requiring a WiFi hub or a smartphone to engage the cloud with healthcare devices.

Today, device OEMs and pharmaceutical delivery companies still have difficulty getting patients to accept all the terms, conditions and risks of using a connected device that will share their data.

Industry Hurdles are the Most Problematic

Nearly all participants reported industry hurdles to delivering connected healthcare solutions, with 58 percent finding them the most daunting obstacles. As expected for healthcare, 57 percent of participants stated that regulatory processes are too rigid for constantly changing technology solutions. With the additional complication of regulations like HIPAA, General Data Protection Regulation (GDPR) and other data governance and privacy rules, it comes as no surprise that industry hurdles top the list.

Not All Healthcare Manufacturers Get to Launch Their Connected Product

Although more than half of the participants said that they have addressed many of their manufacturing, user adoption and industry challenges, the fact that one in five respondents confirmed that their company has halted a launch or pulled a connected solution back after launch confirms that there is still a considerable amount of work to be done. For example, if the artificial intelligence (AI) makes a decision that hurts the patient, who owns the liability of a device that is always learning and changing? Issues like this remain to be solved.

These respondents previously stated that they had solved all challenges and hurdles, yet they listed the following as reasons for retracting a solution:

- Pushback from regulatory agencies

- Lack of professional demand

- Privacy and data security concerns

- Product required too much additional training

- Lack of consumer demand

Connected Health Data: Benefit vs. Barrier

Data collection is primarily driving investments in connectivity. After all, data empowers an organization to make better decisions, be more informed about its customers and improve its solutions based on usage. Therefore, it should come as no surprise that 97 percent of healthcare manufacturers plan to collect data with its connected solutions.

Most solution providers are relying on a public cloud infrastructure such as Amazon Web Services (AWS), Google Cloud or Microsoft Azure, which are widely used platforms for secure connected devices.

Who will fiscally benefit the most from connected healthcare data? Participants believe healthcare providers will be affected most, followed by healthcare manufacturers. But the opportunities extend beyond healthcare. Participants believe insurance companies, retailers and advertisers will also profit from this type of data.

What Partners are Key to Connected Health?

Partners may be one of the best resources for overcoming challenges and advancing the slow-moving connected health industry, as they can contribute valuable experience and knowledge in unfamiliar areas of technology and business. Industry decision makers consider manufacturing partners with expertise in connected devices the most potentially beneficial partners. This is understandable, as manufacturing issues cause many solutions to be pulled back.

Technology partners with knowledge in cloud and data privacy also rank high. Partners that can help solutions avoid the red tape and general tangle of government approval processes will prove helpful in terms of overcoming industry prohibitions.

While progress may be slow, there is a lot of movement in the connected healthcare market. With an increased focus on artificial intelligence and other emerging technologies, we could transform healthcare as we know it. As regulatory processes find their ground working in a connected world, healthcare manufacturers will get smarter with their devices, making a lifelong impact in our lives.

Survey Method and Participant Demographics

An online survey was sent to decision makers at companies that manufacture connected health solutions. A total of 211 individuals worldwide completed the survey. All participants were from companies that had at least 1,000 employees, but most came from organizations with over 5,000 employees. Participants represented a mix of job responsibilities including engineering, research, development, product management and manufacturing.