The European EMS market 2021

By Dieter Weiss, in4ma

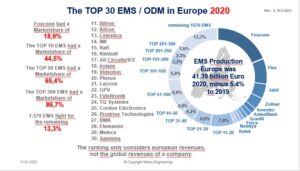

During this research for the last 12 months we realized that the remaining 15% had much lower revenues than modelled in 2019. 85% of all revenues in Europe had been done by 290 companies only, the remaining 15% was 1682 companies and they lost on average 5.2% in revenues, which was 4.5% more than was originally modelled. From 2014 to 2018 the number of companies with revenue growth had been raised from 75% to 80%, 2019 saw a decline to 63%. 37% had a revenue decrease against 2018 and it was mainly smaller EMS which suffered.

This now has led to a reduction of the annual production value 2019 from 44 billion Euro to 43.7 billion Euro. The values for 2020 came out to 41.3 billion Euro, a reduction of 5.4%.

Only the TOP 30 in Europe are shown. TOP 31-50 is a mine field. These are companies working in the defence electronics sector and their EMS share can only be modelled. It also includes companies with majority focus on PCBA repair, OEMs which do EMS as well, and Flex circuitry manufacturers, which today assemble 95% of these flex circuits as well. It can be argued they should not be considered at all. In4ma has a clear definition about what is considered and what is not and this definition has not changed for the last six years. Consistency is the important thing.

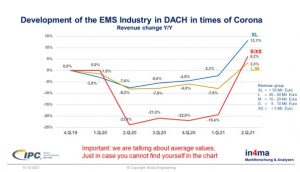

In the first half of 2021, the EMS industry recovered considerably. In4ma and IPC did a half year survey again in 2021. The main focus was on Germany, Austria and Switzerland, knowing that the values do not vary too much from the rest of Europe. Again, reported revenues were analysed by revenue groups and combined with all the analysis results of 2020 to show an overall picture.

This picture shows that the dramatic effect of Corona only started in the 2nd quarter 2020 and that during the next three quarters improvements were only marginal. The real pick up of business happened during the 2nd quarter of 2021. When looking now at the results for the 2nd quarter 2021 and comparing these with the 2nd quarter 2020 it becomes obvious that only the big (XL) EMS are now doing better that 2019. For the medium EMS companies (L/M) there is still a chance to get to 2019 revenues by the end of the year. For the small companies (S/XS) it will take them until 2022 results to get back to 2019 revenues.

For smaller companies, especially those with low equity, it now becomes a hard fight to keep their business going. There are ways to help them to survive; if interested just contact in4ma. Marketing especially becomes more important, especially for the small (S/XS) companies. Some of them are dependent on 3 or 4 customers. The consequences were visible in the 2nd quarter 2020, when the biggest drop in revenues for one company was at 68% and even on average it was 23.9%. Hope will not help in such case, but change might.