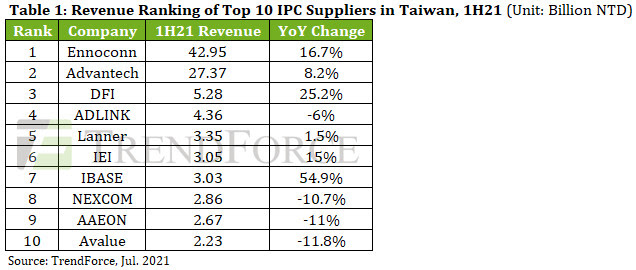

Taiwanese Industrial PC Revenue for 1H21 Reaches NT$115.1 Billion Thanks to Global 5G Rollout and Transport Infrastructure Demand, Says TrendForce

As the Taiwanese IPC (industrial PC) market suffered from deferred orders due to supply chain and logistical disruptions that took place in 1H20, total domestic IPC revenue for 1H20 reached NT$105.4 billion, a 4.7% YoY decrease, according to TrendForce’s latest investigations. However, given that the pandemic was gradually brought under control in 1H21, the market was able to benefit from strong demand from China’s 5G infrastructure rollout, as well as from expanded investments by Europe and the US in public infrastructures such as roads and railways aimed at facilitating an economic recovery. Hence, Taiwan’s IPC revenue for 1H21 reached NT$115.1 billion, a 9.2% YoY increase.

Regarding the financial performances of the top 10 IPC suppliers in Taiwan for 1H21, Ennoconn secured first place with a revenue of NT$42.95 billion, a 16.7% YoY increase. After its acquisition spree that began in 2010, Ennoconn is currently attempting to integrate its various subsidiaries’ technologies and resources in order to make headways in certain emerging technologies, including industrial automation, machine vision, HMI, and cloud services. Going forward, Ennoconn will cultivate its presence in the EV, smart healthcare, and smart retail sectors.

For 1H21, runner-up Advantech posted a revenue of NT$27.37 billion, an 8.2% YoY increase. While Advantech previously favored an acquisition-driven strategy, the company is now expanding into the smart healthcare, smart manufacturing, and smart city sectors primarily through technological partnerships and equity investments. Backed by its WISE-PaaS platform, Advantech continues to expand into the global markets by investing in overseas ISV (independent software vendors) and SI (systems integrators) in the aforementioned sectors.

DFI earned a third-place ranking in 1H21 with a revenue of NT$5.28 billion, a 25.2% YoY increase. After becoming part of the Qisda fleet in 2017, DFI subsequently went on to acquire telecom and information security solutions supplier AEWIN as well as industrial automation vendor Ace Pillar in 2019. These activities culminated in an annual revenue of NT$8.35 billion, an 18.8% YoY increase, for DFI in 2020. DFI currently specializes in smart manufacturing, smart healthcare, and intelligent transportation systems/infrastructures.

AI accelerator suppliers and IPC suppliers work in tandem to clearly define the AI value chain

IPC products have been widely used in AIoT and IIoT applications in recent years due to the proliferation of edge computing. As such, these products have also become the key determinant of how rapidly industries can adopt AI technologies such as machine vision. At the same time, IPC suppliers’ unique position in the mid-stream AI value chain means they are responsible for bridging the gap between upstream AI accelerator suppliers (including Intel, AMD, and Nvidia) and downstream ISV/SI.

With regards to the upstream AI value chain, Intel and AMD acquired independent FPGA suppliers Altera and Xilinx, respectively, in order to achieve more comprehensive heterogeneous computing competencies via horizontal integration. On the other hand, midstream IPC suppliers have been vertically integrating with downstream ISV/SI either independently or collectively through JVs, technological collaborations, strategic alliances, or M&A. For instance, Advantech and ADLINK are now operating on multi-strategy models as well as strategic collaboration models respectively, while Ennoconn and DFI are operating on M&A-oriented models.

On the whole, TrendForce expects that, as AI accelerator suppliers and IPC suppliers push integration forward in the AI value chain, not only will an increasing number of IPC products based on heterogeneous computing platforms be released to market, but emerging AI technologies such as machine vision will also see increased penetration in industrial automation applications. Hence, TrendForce expects annual machine vision revenue to reach US$86 billion in 2025.