Semiconductor and Connector Sales Headed for Record Year

By Ron Bishop

Originally published on TTI’s MarketEye.

The Semiconductor Industry Association (SIA) reported November sales of $41.4 billion, up +9.8% from prior year and down -1.1% sequentially. Regionally for November, the SIA reported that China grew +17.4% YOY, Japan grew +5.6%, Asia Pacific/Other grew +4.4%, the Americas grew +8.8% and Europe grew +5.8%. The overall YOY sales growth has slowed for the last seven consecutive months.

The connector industry sales, measured in U.S. dollars, increased +2.7% to prior year and increased 6.7% sequentially. Regionally for November, YOY sales increased +9.7% in North America, +4.5% in Asia Pacific and +9.4% in ROW. Japan decreased -2.7%, Europe decreased -0.3% and China decreased -0.3%.

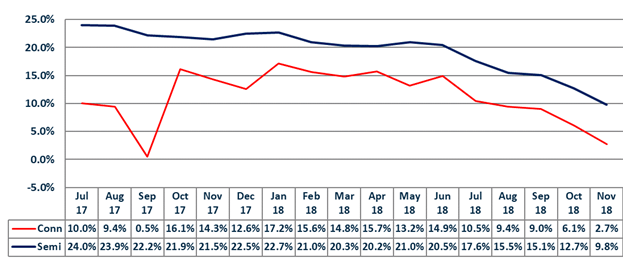

The following graph compares semiconductor sales performance to the connector industry.

Monthly Sales Performance

Year-Over-Year

- Semis grew for the 28th consecutive month and have outpaced connectors for the last 24 months, but the YOY results are getting much closer. In November, semis ended 23 months of growing in double-digits.

- Semi sales growth continues to tail down. Connector growth is also slowing down due to difficult comparisons to prior year.

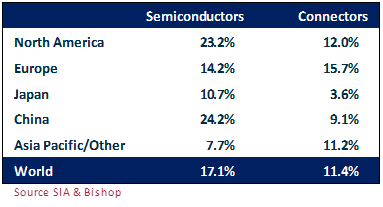

The following table displays year-to-date performance, measured in U.S. dollars, by geographic region for both components.

Sales Performance

November Year-To-Date

Both components sales growth performance is tracking more closely in total world sales. On a regional basis, however, performance is diverging in North America, Japan and China.

High demand for semiconductors always leads to strong connector sales. Both components had record sales in 2017 and will have strong, record performance for the full-year 2018.

Connectors are projected to grow +11.4% in 2018 to $66.9 billion. The SIA projects semiconductors to grow +12.4% in 2018 to $463 billion.

The impact of the various tariffs between the major economies is not showing an obvious effect on the performance of either semis or connectors.

Except for the United States, the major world economies are slowing down which will impact semiconductor and connector sales performance in 2019.

Statements of fact and or opinions expressed in MarketEYE by its contributors are the responsibility of the authors alone and do not imply an opinion of the officers or the representatives of TTI, Inc.