Managing Choke Points: Eastern European Conflict’s Impacts on the Electronic Components Ecosystem

SOURCE: TTI MarketEye

By

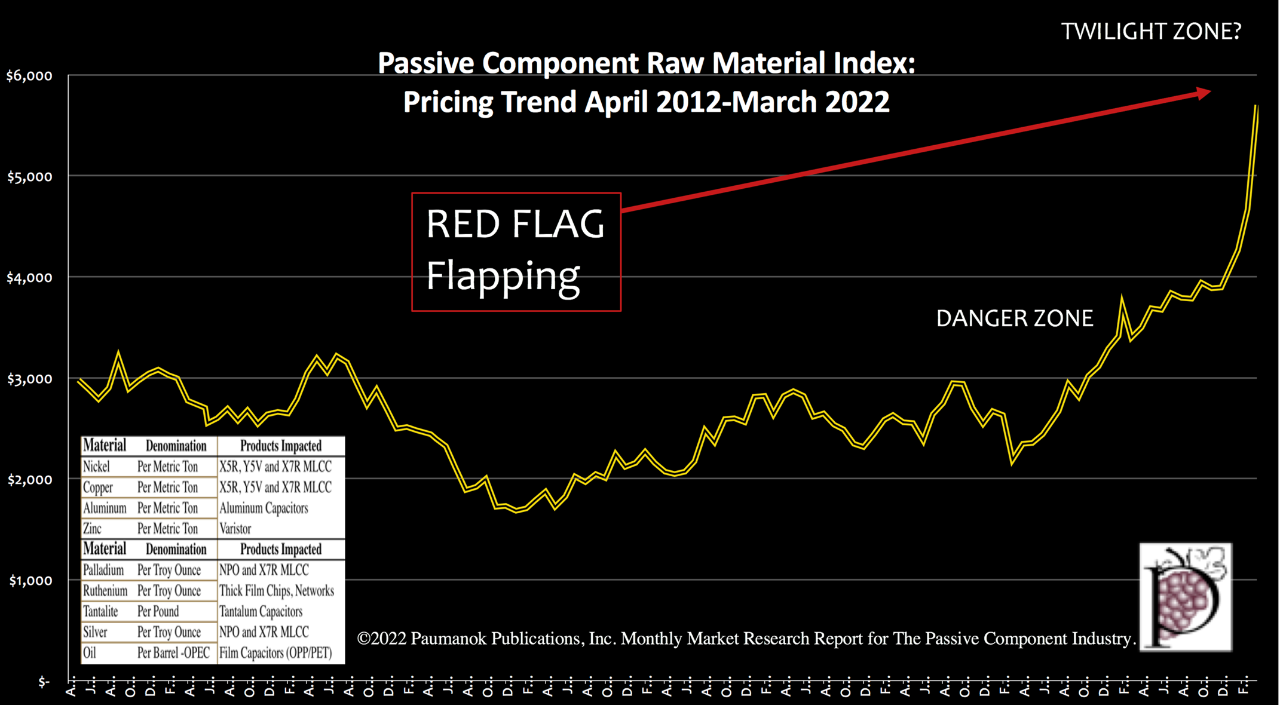

Tension turned to conflict in eastern Europe in March 2022, causing prices for multilayered ceramic chip capacitor (MLCC) keystone metals to increase accordingly. Pricing for nickel and palladium, both MLCC electrode materials, increased sharply, with nickel taken off the London Metal Exchange (LME) due to a one-day, triple-digit price hike, causing the Paumanok Passive Component Raw Material Index to spike to uncharted levels (see figure 1).

Figure 1: Passive Component Raw Material Index – Pricing Trend, April 2012-March 2022, by Month

Source: Paumanok Publishing, “Passive Electronic Components: World Market Outlook, 2022-2027” (2022)

The price of palladium also jumped during the month as investors at key choke points in the high-tech supply chain worried about rising ore costs on top of hyperinflation, coupled with fear of continuity of keystone metal supply.

Such materials-related events in the past were ingredients for panic buying of electronic components consumed in handsets, computers, game consoles and automobiles.

We are forecasting the potential disruption of MLCC capacitors, resistors (all types), aluminum capacitors and all ferrite products in the April-December 2022 timeframe. Disruption may come in the form of volatile pricing for nickel, palladium, copper, titanium, aluminum and iron ore, and may result in materials shortages for electrodes, dielectrics and terminations consumed in electronic components.

This also means that these feedstock materials will have intrinsic value as packaged components, thus potentially fueling net-new sources of recycled metal.

A channel check of the mission critical PGM MLCC supply chain revealed that key suppliers of PGM-based MLCC for mil-spec, space, medical, oil and gas and semiconductor manufacturing equipment had palladium – a key choke point – stockpiled for 18 to 24 months of continued operation.

The aluminum supply chain also reacted with a price jump because of the concentration of smelting operations in eastern Europe from RUSAL PLC. The supply of aluminum is important for aluminum capacitors as dielectric anode and cathode foil, but is also keenly important for resistors, produced largely in China. The feedstock material for resistor substrates is 96 percent alumina ceramics and therefore, the perceived value of resistors, the weakest link in the entire high-tech economy, just increased substantially.

Magnetics are most compelling. The target of the war in eastern Europe seems increasingly that it may be the iron ore mines in and around Poltava, which are feedstocks for steel, but also for ferrites. Chinese factories reported a shortage of iron ore for steel on March 28, 2022 and a 4 percent, 1-day price increase. We caution on the entire ferrite-based supply chain (ferrite beads, bead arrays and ferrite cores).

This report shows that aluminum capacitors and plastic film capacitors showed increased demand and tightening in March 2022, while MLCC and tantalum showed signs of weakness due to excess inventories in handset and automotive supply chains. Thin film resistors, based upon nickel, showed tightening, but this supply chain was also affected by the Fukushima quake as was the supply of high voltage anode foil.

Also, mining operations in China are reporting that the resurgence of COVID-19 in China in March is hindering the return to steady production flows of key materials.

Read more Component Market Updates>>