From the Publisher: EMSNOW On Tour – Guadalajara, Mexico

By Eric Miscoll, EMSNOW Publisher

Eric Miscoll, EMSNOW Publisher

I have been traveling regularly to Guadalajara for almost 20 years to research and track the progress of the electronics manufacturing industry there and I always enjoy the experience immensely. I remember a report I completed several years ago entitled ‘Guadalajara Rocks’ and that came to mind again this trip for reasons I will explain later in this article. I’m a big proponent of electronics manufacturing in Guadalajara, and I believe it is one of the top locations on the planet for EMS. I came home from my latest trip there even more impressed and enthusiastic than before.

My four-day visit included attending the SMTA Expo Guadalajara where I visited the booths of some of the exhibitors and had the pleasure of listening to an excellent presentation by Indium’s Brian O’Leary about electric mobility. Around the show, there was palpable energy and excitement about the industry. Reports of business growth dominated all conversations. I heard discussions about facility expansion and new equipment required to accommodate the expected growth. Re-shoring is real, and the consensus is that Mexico will continue to be the beneficiary of much of the return of manufacturing to the Americas.

The automotive end market sector is driving growth, especially EV. Even those companies not engaged currently with EV expect to serve those customers in the near future. Aeronautics has also been historically important, but there is definitely growth in medical/life sciences, industrial ( and all that includes), communications, and there is also talk of semiconductor manufacturing coming to the area.

There are challenges, of course.

Component shortages are still cited as the number one challenge. This was characterized as ‘still critical’, a ‘delicate matter’, and the supply chain was referred to as ‘fragile and unpredictable’. Supply chain costs, including logistics are increasing, and that was cited as a concern.

The second most cited challenge is workforce related. In spite of Mexico’s excellent university system producing hundreds of thousands of engineers every year, recruiting and training workers is a top of mind challenge for the executives I met. This is a reflection of the industry’s incredible growth and is expected to continue. Competition for workers among the EMS operating in Guadalajara is intense; creating a positive work culture has become of critical focus for companies.

Facility space expansion is another challenge, with several EMS mentioning greenfield initiatives launching in the next few years. And the type of facility is evolving as well. The work being planned is not just high volume/low mix manufacturing. There is more low and medium volume/medium mix being done as well.

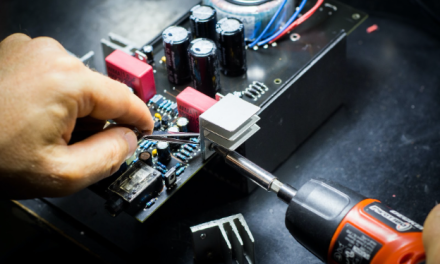

EMS Facility Tours

While in Guadalajara, I also visited with four global EMS companies with operations in Guadalajara. I saw a great variety of manufacturing styles and platforms on these tours. These are some of the most impressive EMS facilities I have seen in North America:

Each of these facilities was impressive in a unique way. Several have planned expansions, and will be purchasing new equipment. We discussed their strategies to keep up with the growth, and I found these managers well prepared for the future. I very much appreciated the gracious welcome and the time spent showing me around.

Overall, I learned that relationships with OEMs have gotten stronger and closer through the events of the past few years, i.e. pandemic and supply chain disruptions. What really impressed me was the strong focus on the employees; respect and care for the people seems to be a high priority. Clearly this is likely due to the intense competition for skilled labor, but it is also a recognition that higher salaries are not the only thing of value to workers. A positive and engaging work culture is crucial.

There is some discussion of expansion of electronics manufacturing into the Southern parts of Mexico, due to the increasing burden on the infrastructure of continued expansion in northern Mexico, especially water. The southern areas of Mexico typically benefit from greater water resources than do the drier areas in the north of the country.

Guadalajara Rocks

Overall the future of manufacturing in Guadalajara is particularly bright in Q4 2022 and beyond. However, there was an earthquake on September 19th, the day before I arrived, and another in the early morning hours of September 22nd, and then again on the date of my departure. Interestingly, there have been two previous earthquakes in Mexico on September 19th – in 1985 and 2017. Since I spent many years in and around San Francisco Bay Area I am fortunately immune to the effects of tremors and easily went back to sleep; I then found out the next morning that several hotels nearby had been evacuated!

So…. Guadalajara still rocks… in many ways! I stand by my earlier assessment.

Profiles of 4 EMS Visited in Guadalajara 2022

All Circuits / GDL Circuits

- allcircuits.com

- General Manager: Pascal Aubois

- Markets Served: Automotive, Industry & Energy, Communication & IoT, Medical

- Services Provided: Full lifecycle

- Facility: Opened in 2019; ~300 employees; 1 building; 25,500 sq ft manufacturing space; 3 SMT lines

- True “low touch” facility

Benchmark

- bench.com

- General Manager: Brian Smillie

- Markets Served: Aerospace & Defense, High-Performance Computing, Complex Industrial, NextGen Telecommunications, Medical, Semiconductor Capital Equipment

- Services Provided: Full lifecycle

- Facility: Opened in 1997; ~1500 employees; 2 buildings; additional site planned for 2023

- One of two Benchmark facilities in Mexico. The other is in Tijuana.

Integrated Micro-Electronics (IMI)

- global-imi.com

- General Manager: Thomas Caveneget

- Markets Served: Automobile, Industrial

- Services Provided: Full lifecycle

- Facilities: 2 buildings (1 for EMS, 1 for plastic injection molding); ~1800 employees; 10 SMT lines; 43 plastic injection molding machines.

- Vertical integration strategy is apparent.

Plexus

- Plexus.com

- General Managers: Ramon Nogales (AZTECA Site) & Juan Manuel Jiménez Medina (MAYA Site)

- Markets Served: Medical, Industrial

- Services Provided: Full lifecycle

- Facility: 2 buildings; opened in 2014 and 2020; ~4500 employees; 394,000 sq ft of manufacturing space; 9 SMT lines

- Immaculate facilities in all areas.