ECIA Offers New Report to Members Extracted from U.S. Import Data

| Atlanta–To support association members, ECIA has developed a database that organizes data by common industry categories going back to 1992. Information extracted from this database can be used to understand the flow of imported electronics components into the U.S. and how the supply base is shifting around the world over time. The data that has been extracted from the larger database and presented in this report provides visibility into component categories that represent approximately 90% of the revenues that flow through the authorized distribution channel.

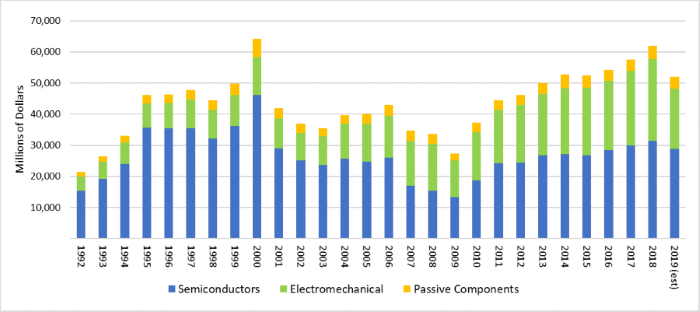

ECIA’s Chief Analyst Dale Ford examines this data in his latest report. “Strong supply chain management is critical to the success of all participants in the electronics industry,” he explained. “Procurement managers continually seek to optimize their understanding of the risks and evolving forces that continually reshape their supply ecosystem. A key element in their efforts is achieving the best visibility possible of both the macro and micro factors shaping the supply base. This typically means developing and managing data that can form the basis for informed decisions and action plans.” The data charted in the figure below illustrates the annual import revenues from electronics components split out by semiconductors, electromechanical and passive components. Import revenues have grown fairly steadily from 2009 to 2018 reaching a peak of $62B in 2018. The highest annual peak recorded was in 2000 at $64.2B. Of course, this was part of the dot-com boom and bust when large levels of excess inventory bloated the supply chain and resulted in an extended downturn in factory shipments of electronics components and required significant value to be scrapped and written off as part of rebalancing the supply chain. The current weak electronics production environment is seen in the extrapolated revenues for 2019 with a projected drop of -16% to $52.1B.

The full ECIA Executive Analysis provides figures and statistics with historical revenues and growth rates by product category going back to 2003. Annual market shares by country for the top exporters of electronics components to the U.S. are presented beginning in 1992. Data with quarterly resolution is presented for 2018 through Q3 2019. These countries account for between 80% and 90% of revenue from all electronics components imported into the U.S. during this period. The overall database developed to this point covers imports of electronics components. Current plans anticipate future development of export data and expansion to the coverage of electronics equipment. To see the full ECIA Executive Analysis visit www.ecianow.org, log on and click on the “Members Only” section under Quick Links. |

|

| About ECIA

The Electronic Components Industry Association (ECIA) is made up of the leading electronic component manufacturers, their manufacturer representatives and authorized distributors. ECIA members share a common goal of promoting and improving the business environment for the authorized sale of electronic components. Comprised of a broad array of leaders and professionals representing all phases of the electronics components supply chain, ECIA is where business optimization, product authentication and industry advocacy come together. ECIA members develop industry guidelines and technical standards, as well as generate critical business intelligence. For more information, visit www.ecianow.org or call 678-393-9990. |