Transportation Market Update Q2-2022: Air & Sea Freight

Source: Asteelflash Blog post

Nobody is expecting the current market conditions to last, mainly because rising inflation is casting a shadow over consumption, which has been the biggest driver of the tidal wave of cargo that has overwhelmed ocean carriers, ports, rail and truck operators as well as the airfreight industry.

Bellyhold capacity has shown a bumpy road to recovery, with the biggest hurdles in the long-haul markets, where it played the most significant role before Covid.

That role is going to be diminished:

- Air cargo demand was flat in the first quarter of the year as Russia’s invasion of Ukraine and lockdowns in China put the breaks on growth.

- Figures from WW experts show that chargeable weight transported by air cargo increased by 2% year on year in January and February but then slipped to a decline of 3% in March.

- Lockdowns in China had a big impact resulting in a 13% decline in outbound air cargo and a 23% decline in inbound air cargo business to/from the country.

The air cargo market could see its supply-demand balance return to pre-covid levels in 2025, although that prediction comes with a plethora of caveats: Air Freight cargo capacity is expected to reach 2019 levels in around 2023 but, in the meantime, demand will continue to rise, meaning supply and demand will not come back into balance until around 2025.

The container port congestion is expected to remain, e-commerce demand continues to rise, and supply chains face disruption due to missing parts, all of which will favor air cargo.

Besides, PPE demand has been a “huge part” of air cargo volumes over the last few years but this demand in many markets is also beginning to ease. However, disruption and high prices in ocean shipping might boost the use of airfreight to support supply chains.

The year 2021 was a record year for air cargo with demand up by 7.1% compared with 2019 and so far in 2022, capacity remained around 5% down on 2019 levels.

Therefore, it will be a while before we get back to the equilibrium we saw in pre-Covid times.

SEA FREIGHT

Shanghai has entered its fifth week of confinement. If production in factories resumes, it is very gradual, for lack of components and because of limited road transport (-70% approximately).

The impact will be felt for at least another three months, many manufacturers estimate. According to the Shenzhen Cross-Border E-Commerce Association, which represents 3,000 Chinese exporters, even though this city’s lockdown only lasted a week, “many sellers are suffering from a delivery delay of about a month”.

Unsurprisingly, port congestion is increasing and the quality of service is dropping sharply in China:

- Delays are increasing: they reach 11 to 12 days from Shanghai to Rotterdam or Hamburg and even almost 16 days between Shenzhen and Hamburg

- A container now takes 118 days on average between a Chinese shipper’s door and a European port exit, twice as much as a year ago

- Port congestion is high: last week, 230 ships were waiting off Shanghai and Ningbo. The number of ships waiting for all of China is up 195% compared to February of this year

- The 2M alliance (Maersk and MSC) announced blank sailings on the Asia-Northern Europe trade in May. Bookings are predicted to be down 40% on this trade lane.

SUPPLY CHAIN

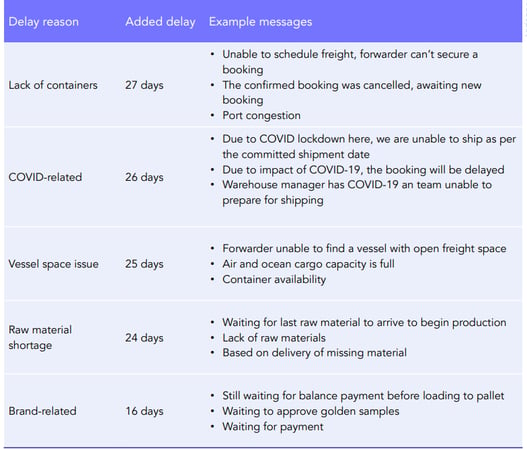

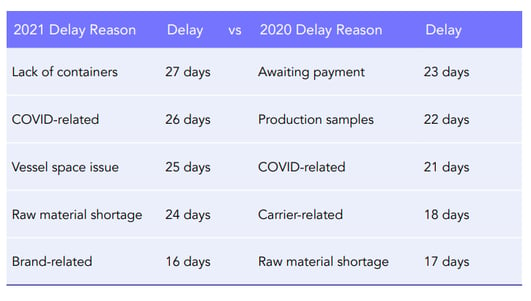

The top 5 supply chain delays have certainly evolved from when the pandemic first started in 2020. When making comparisons with 2020, one can see how shipping-related delays exacerbated in 2021, while brand-related delays like awaiting payment or production sample approvals significantly improved. With respect to other delay reasons that are outside of the control of the brand, those related to shipments, COVID closures, and raw material shortages have impacted WW supply chains in 2021 and will continue to impact them in 2022.