What Does a ‘Good’ CEM Now Look Like?

By Dan Attewell, Offshore Electronics

Closer contact between outsourced partners and in-house engineers is now far more common than it was even just three years ago, and it’s not unusual for in-house engineers to now consult with their counterparts in partnering organisations. To some, this may sound inefficient, especially when ‘success’ in manufacturing is often measured against hard numbers, but it’s actually making the industry far more effective long term.

Two-Way Street

Like most changes in modern manufacturing, the shift has mainly been driven by competitiveness. Products are still assembled to specification, of course, but difficult trading conditions have made OEMs more aware of how suppliers can be used to their advantage. This extends beyond purchasing – though CEMs are often best placed to source components with full traceability – and now involves departments that have usually been one-step removed from the customer, such as prototyping and testing.

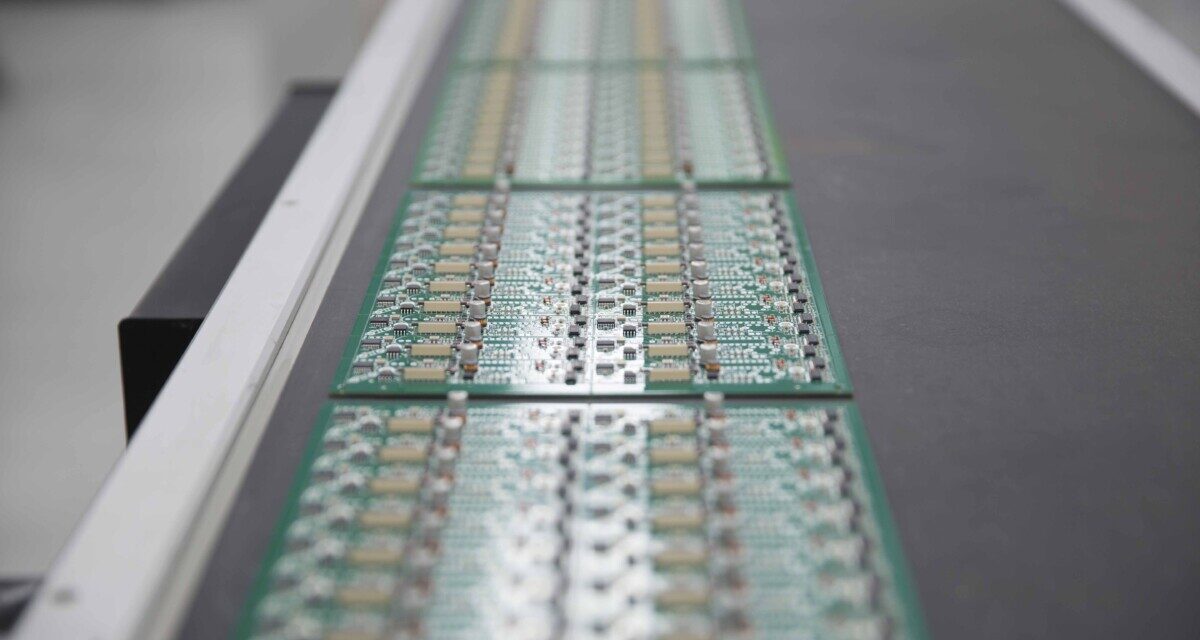

If a CEM is engaged at the earliest stages of a brief it will be in a better position to suggest more efficient ways of assembling a PCB. At Offshore, this process has played out countless times since supply chain issues began to bite in 2019 and has been an invaluable resource for customers with parts still on allocation and back orders stretching months, or even years, ahead.

Having multiple points of contact, however, is not only beneficial for getting boards out of the door. It also allows a CEM to be more proactive with a PCB’s design, as it can suggest potential improvements to the layout and avoid some of the common challenges customers run into with grid spacing and trace lengths. Temperature grades are another area where collaboration is useful. For a hospital part, extremely low temperature grades are not required yet some in industrial applications parts will need to be capable of working between -20C to 40C. This issue will be known by an in-house engineer and their procurement team, though they may come unstuck if the originally specified part is in short supply, like thousands have been for the last three years.

Like most things in business, this more equitable way of working is only as good as its weakest point and communication needs to flow in both directions. In-house engineers must be open to credible alternatives – especially if they have a deadline – while the CEM needs to be mindful of changes that could delay an assembly or lead to complications during validation. Offshore, for example, has been able to use its supplier network to keep lead times to a minimum, offsetting much of the trouble that other OEMs have faced when opting for what appears to be the more ‘competitive’ option.

Visibility, Anticipation and Documentation

CEMs with better visibility can also prevent build-ups in the supply chain. For example, it can be very time consuming if an engineer approves a bill of materials but the product’s second- and third-tier parts have to be sourced if the first is unavailable. Having sight of this beforehand gives purchasing enough time to make corrections, both in terms of the components and the logistics needed to actually ship them to the manufacturing facility. Again, with air and sea freight still unpredictable, this kind of forward-thinking can make all the difference.

It’s also important to remember that a change of product is far more complex than a like-for-like swap. Granted, a footprint change on a board is relatively simple, but if you change a processor that will often mean an update to all the programming and user manuals will be necessary. Anticipating these issues – something once regarded and costed out as ‘extra’ – is the hallmark of a proactive CEM. They will be constantly assessing where time is best spent, even if that means spending some more of it on the phone with clients.

It would be remiss not to point out that tight regulations – like UL – have made sourcing parts more difficult. However, this is another area where a proactive supplier can catch errors before they begin to affect a build. If a CEM can see a bill of materials ahead of production, it can offer like-for-like alternatives, saving time spent on revalidation at a later stage. In-house engineers making small design oversights and poor documentation are still common, and in some respects always will be, so it’s important for the CEM to have rigorous processes in place that ensure paperwork is accurate and up to date. Given increasing scrutiny on electronics manufacturing in general, this should be one of the first checks before a single component is placed.

ISO standards offer a good case in point. ISO has changed from a form of general business management to something mainly focused on risk. Nowadays most OEMs work to this standard, which makes the entire process far more straightforward as both parties are thinking about purchasing and production in the same way. By being ISO-accredited, a CEM can also pinpoint where errors have occurred and quickly put remedial actions in place.

It’s been incredibly challenging for the electronics industry in recent years, and especially for CEMs having to battle pressures on two fronts. Yet some of the changes that have come out of that time have ultimately led to more efficient manufacturing practices. It seems counterintuitive to spend longer on a PCBA contract when the overriding goal is to build, test and ship as quickly as possible, yet services that were once deemed ‘extra as standard’ have suddenly become essential for OEMs looking to get product to market.