Trade Policy Insights: US Automotive Exports to EU – Further decrease?

By Daniela Stratulativ, Associate Director, Global Trade | Maritime & Trade

This column is based on data from Global Trade Atlas, IHS Markit.

The US Mexico NAFTA and the EU Japan Economic Partnership Agreement (EPA) could affect US Automotive Exports to EU:

- EU is the largest US Auto export market in value, representing 9.43% of total US Auto Exports of 130 bn USD. EU imports of Auto products from US decreased by over 5% in 2017 over 2016 and were close to 12.3 bn USD.

- Motor cars and parts are the highest EU imports of US Automotive products. EU motor cars imports reached close to 51bn USD in 2017 and increased at 20%, while US exports to EU were close to 7.3 bn USD and decreased by 9.7% from previous year.

- EU demand for US motor cars might decrease due to higher prices of US cars as result of NAFTA and lower tariffs on Japanese cars due to the new EU Japan EPA. Consumer choice will play a role also in shaping demand for US motor cars.

- China and EU are the largest markets for US motor cars by volume, therefore it will be difficult for US to expand into other markets to compensate for decreased share as EU supplier.

Next steps:

NAFTA: Canada, Mexico, China and EU are the largest importers of US motor cars, by value. Current negotiations between US and Canada could influence trade volumes. On Wednesday, Washington announced that talks between US and Canada could be concluded by the end of the week, while Canadian Foreign Affairs Minister Chrystia Freeland declined to say how close the two sides were.

EU – Japan EPA: Signed on July 17, 2018, it is expected to enter into force in 2019. Tariffs on cars will be lower than EU tariffs on US cars, and eventually eliminated.

Other factors that could influence these findings: Japan is currently negotiating several bilateral trade agreements, a trilateral agreement, and it is taking part in the negotiations of several regional trade agreements.

Effect on the supply chains and shipping industry

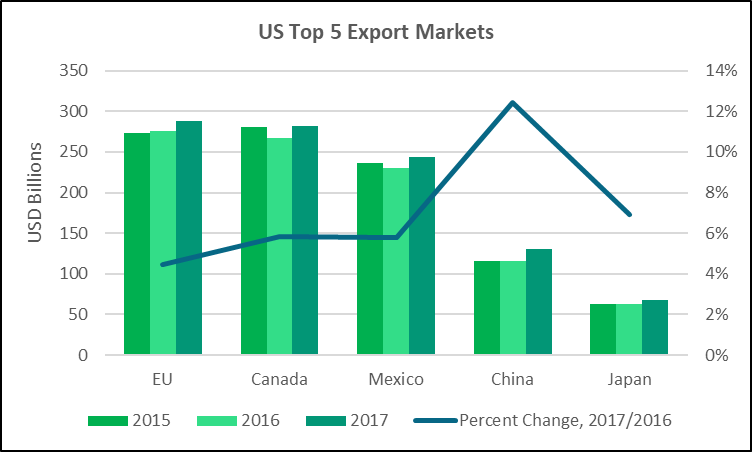

EU is the largest US Export Market by value

US exports in 2017 reached over 1.5 trillion USD, with EU market representing 18% of US Exports, with growth of 4.48% over 2016.

Source: IHS Markit © 2018 IHS Markit

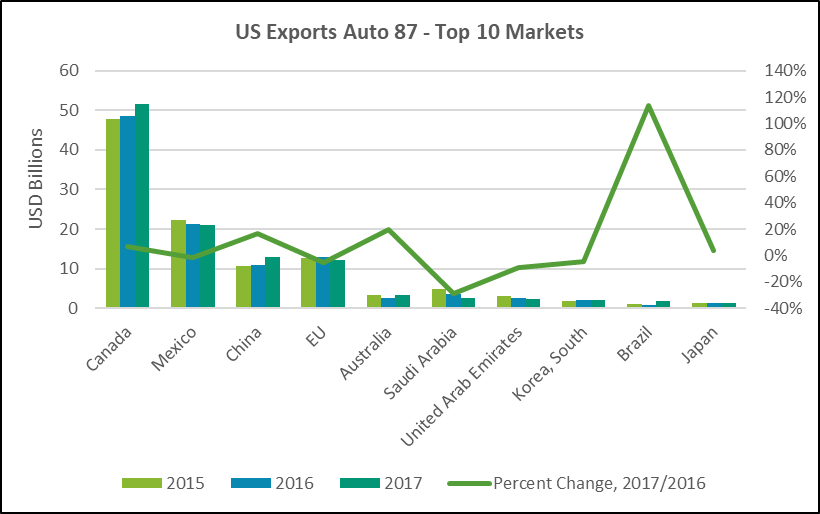

US Auto Exports to EU represent 9.43% of total US Auto Exports by value

US Automotive industry total exports were close to 12.3 bn USD with decrease of over 5% in 2017 over 2016.

If demand from EU decreases, where can US export instead:

Source: IHS Markit © 2018 IHS Markit

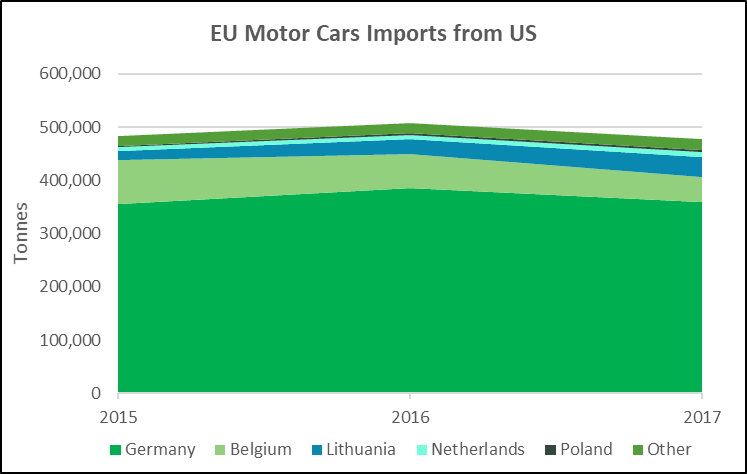

EU import market for Motor Cars in 2017 close to 51 bn and increased at 20%, with US imports decreasing. Several factors might lead to US share decreasing further.

EU motor cars imports from US in 2017 reached 7.3 bn USD, decreasing by 9.69% compared to previous year. EU total imports of motor cars in 2017 were close to 51 bn USD and increased by 20% over 2016.

The EU market for motor cars is growing, yet, will demand for US imports continue to decrease?

Several factors will influence demand for US motor cars, among them being higher North American content of manufactured cars of 75%, and requirement of 40-45% of content to be produced at $16 per hour, which will lead to increase in price. Steel and aluminium could also contribute to higher price. Consumer choice will play a role also in determining trade volumes.

In addition, the recently signed EU Japan EPA scheduled to enter into force in 2019, tariffs on Japanese cars will be lower than tariffs on US vehicles. EU tariffs on Japanese cars will be decreased from 10% by 1.2% each year after the EPA enters into force. After a period of 7 years (with 7th year of 1.3%), tariffs will be eliminated.

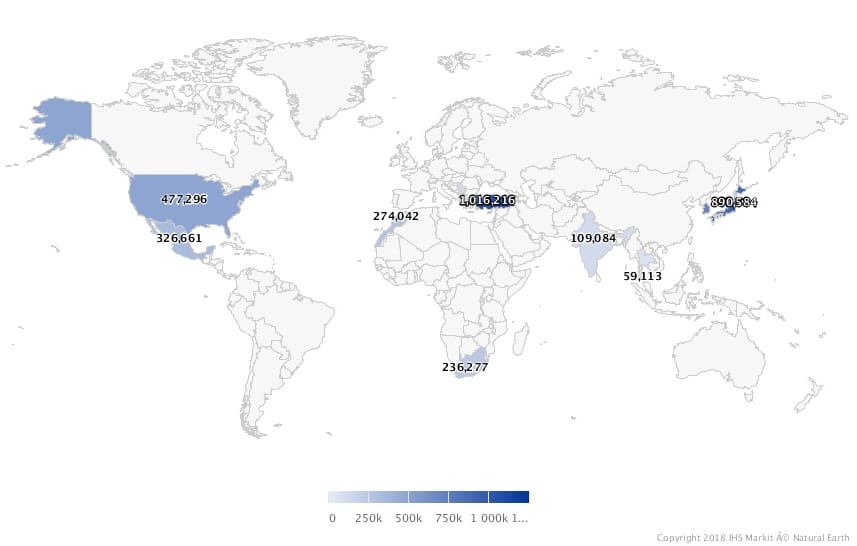

EU Top 10 imports of Motor Cars in 2017 (Tonnes)

Source: IHS Markit © 2018 IHS Markit

Germany and Belgium import highest volumes of US motor cars among the EU states, with trade volumes decreasing at 7% and respectively 26%, while imports to Lithuania, Netherlands and Poland increased.

Source: IHS Markit © 2018 IHS Markit

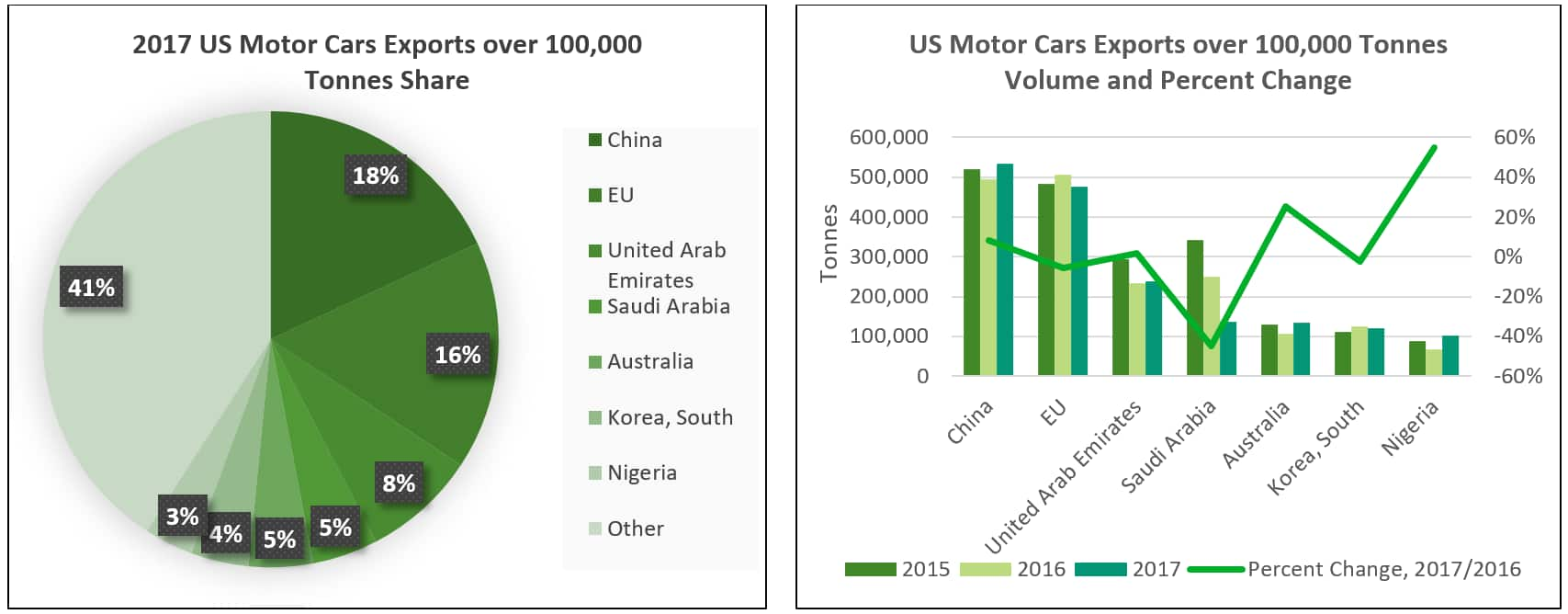

Due to above mentioned factors, EU demand for US cars could decrease. Current US trading partners who account for imported US cars volumes of over 100,000 tonnes outside EU are China, United Arab Emirates, Saudi Arabia, Australia, South Korea, and Nigeria. Although Australia and Nigeria registered the highest increase in volume in 2017, they account for only a small share of the total US vehicles export market, the largest being China and EU.

If EU demand for US cars decreases, it will be difficult for US to expand into other markets to compensate for decreased share as EU supplier.

Source: IHS Markit © 2018 IHS Markit

Research based on trade statistics for the following products:

- HS code 87 (Vehicles, Other Than Railway or Tramway Rolling Stock, And Parts and Accessories Thereof), referenced in the article as ‘Automotive’.

- HS code 8703 (Motor Cars and Other Motor Vehicles Designed to Transport People (Other Than Public-Transport Type), Including Station Wagons and Racing Cars), referenced in the article as motor cars / vehicles.