in4ma’s TOP 25 European EMS

By Michael Künsebeck, in4ma

For the European EMS industry, in4ma thoroughly analyzes the companies based on published reports and survey data. Together with IPC, in4ma conducts an annual survey in January of each year. This survey is becoming increasingly accepted and participation continues to expand; we now have over 270 participating companies. However, the surveys are confidential and unless the data have been made public, not all revenues are included in the following list of the Top 25 European EMS.

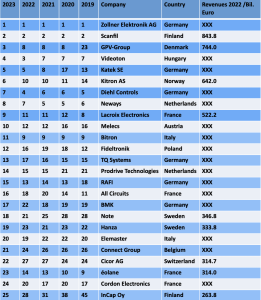

The list below shows the development of the rankings over the last five years, whereby the rankings for the years specified were always created with the sales of the previous year. However, the list requires some explanation to avoid misunderstanding.

Company performance is related to both organic and inorganic (i.e., M&A) growth. In addition, global revenues for the companies were used for the ranking. Let me explain.

Let’s start with Pos. 25, the Finnish InCap Oy. In January 2020, InCap bought AWS Electronics Group with plants in UK and Slovakia. This caused the jump from 38th to 31st place. In addition, the company is expanding strongly in India and is currently building its third plant there, which will be inaugurated in May 2023.

Number 24 is a company that many people don’t have on their radar. In 2009, Serge Cordon took over Sony’s former repair facility in Alsace and quickly realized that repairing and refurbishing electronics for third parties could be profitable. Since then, he has continuously expanded worldwide. Today Cordon Electronics has 23 locations worldwide.

In 23rd place is éolane from France, which has many plants in France as well as in Germany and Estonia. It has only grown organically and has fallen behind massively as a result.

The Swiss company Cicor AG is in 22nd place. Relatively stable for several years, after the entry of One Equity Partners in July 2021 (acquisition of 29%), the company took a different direction. In December 2021, Axis Electronics Ltd was bought in the UK, followed in February 2022 by the takeover of the German company, SMT Elektronik GmbH, followed by the takeover of Phoenix Mecano Digital Elektronik GmbH in Germany and Phoenix Mecano Digital Tunisie S.a.r.l in Tunisia. In December 2022, the year ended with the takeover of thin film specialist AFT Mircowave GmbH in Germany. Further acquisitions are eagerly awaited. EMSNOW & in4ma visited the Bronchhofen factory in December 2021.

At the Belgian Connect Group, nothing significant has changed in its position for many years. That changed in April 2021 with the takeover of IKOR Sistemas Electronicos SL in Spain and Mexico. This put the Connect Group in 21st place.

The last acquisitions by the Italian Elemaster Group were a long time ago. The last acquisition was the Belgian GDM Electronics with plants in Belgium and Romania in April 2018. The ranking at number 20 has therefore been relatively stable over the last five years.

List of European TOP 25 EMS from in4ma, Rev. 5, 28.3.2023

The Swedish company Hanza AB first attracted attention in Germany with the purchase of Ritter Elektronik GmbH from Remscheid in August 2019. This was followed by Helmut Beyers GmbH from Mönchengladbach in October 2021 and Budelmann Elektronik GmbH in June 2022. This put them in 19th place for 2023.

Swedish Note AB also repeatedly drew attention to itself through acquisitions. Speedboard Electronic Assembly Ltd in the UK was launched in November 2018, followed by iPro Holding Ltd. in June 2021 and Dynamic Precision Solutions AB in Sweden in July 2022. This means that Note has climbed ten places in the last 5 years and is now in 18th place.

The German BMK Group, which operates another plant in Israel in addition to the plant in Augsburg, occupied 17th place. EMSNOW & in4ma visited the plant in Augsburg in December 2021.

The French company All Circuits Group with two plants in France and one plant in Tunisia is in 16th place. EMSNOW & in4ma visited the MSL factory in November 2022.

The German RAFI Group is in 15th place, which is only taken into account with its EMS sales, but also has a wide range of its own electronic components. EMSNOW & in4ma visited the RAFI Eltec factory in December 2021.

The Dutch Prodrive Technologies BV has made its way to 14th place solely through organic growth. EMSNOW & in4ma visited the factory and HQ in Eindhoven in November 2022.

TQ Systems has not had any acquisitions to report in recent years, and 13th place was achieved solely through its own sales success.

In 12th place is a company that many insiders do not necessarily know, the Polish Fideltronik Sp. Z.o.o. This company has also grown purely organically.

The Italian company Bitron took 11th place. Here the ranking is not very clear. The main plant of Bitron’s electronics division is in Poland, with over 330 million euros revenue annually. However, there are also several plants in Italy, not all of which can be assigned to the EMS sector. In addition to a strong share of sales for the automotive industry and consumer electronics (ELDOM), there are the strong areas of HVAC (heating, ventilation, air conditioning) that are not considered. Another electronics plant is in Mexico. In total, Bitron has 50 SMT systems.

The Austrian MELECS Group achieved 10th place. At the end of 2018, 70% of Prettl’s electronics factory, Prettl Electronics Querataro SA de cv, was taken over and then they steadily worked their way up the rankings.

The French Lacroix Group, with plants in France, Estonia, Germany, Poland, and Tunisia, fought for ninth place after the American Firstronic LLC took over in December, which ensured a leap forward. EMSNOW & in4ma visited their newest plant Symbiose in Beaupréau-en-Mauges in November 2022.

The Dutch company Neways, which has just been taken off the stock exchange, is in 8th place and will probably soon be making a name for itself with new management. EMSNOW & in4ma visited the German plant in Neunkirchen in December 2021.

Not everyone has Diehl Controls, a division of the Diehl Group in Nuremberg, in their sights. With four plants in Germany (Wangen), Poland, China and Mexico, it has focused on individual market segments in the EMS area and is quietly working in 7th place.

The Norwegian Kitron AB took sixth place. With the purchase of API Technologies Corp. in the USA they made the leap across the Atlantic in November 2018. In December, BB Electronics AS, a larger European player, was bought, which in turn bought the Czech Wendell Holding a.s. in February 2019. EMSNOW & in4ma visited the Swedish factory in Jönköping in October 2022.

Katek SE, which is listed on the stock exchange, now occupies fifth place. Katek also had an eventful M&A history in the EMS industry and thus worked its way forward. After the purchase of ETL Elektrotechnik Lauter GmbH at the beginning of 2019, Bebro Electronic and E-Systems MTG followed in August 2019. The Leesys Group in Leipzig and Lithuania followed in January 2021, and Aisler B.V. in May 2021 from the Netherlands, iOX Mobility GmbH in October 2021, Canadian SigmaPoint Technologies in April 2022, and American Nextek Inc. in November 2022. We hope we haven’t forgotten anyone with all the acquisitions. Katek is the No. one in Europe at least in terms of the number of acquisitions. EMSNOW & in4ma visited the Mauerstetten factory in November 2022.

4th place is taken by Videoton, which was only considered by in4ma with two PCBA works for a long time. However, this was a misjudgment, because after all there are a lot of other separate independent units that generate sales in plastic injection molding, sheet metal fabrication in box building and other services, all of which must be attributed to the EMS division and in other EMS companies under one legal entity unit are organized. This was clarified when in4ma visited Videoton in March 2022.

The GPV Group, which belongs to the Danish Schrouw Group, is in third place. We can already hear the cry from the EMS industry that that can’t be right. After all, GPV took over Enics last year. The deal was already announced in July 2022, but the closing did not take place until October 2, 2022, and so only the sales of Enics in the fourth quarter of 2022 could be considered for 2022. If you take full annual sales, then the newly created GPV Group is of course larger than the current No. 2, the Finnish Scanfil Oy. GPV jumped already from Pos. 23 to Pos. 8 in 2019, after having taken over CCS of Switzerland. EMSNOW & in4ma visited the former Enics Factories in Estonia in November 2021 and in Sweden in October 2022.

Scanfil is in second place in terms of 2022 sales but will have to make a significant leap over the one billion mark in 2023 in order to maintain this position. This will hardly be possible organically, but nothing can be ruled out inorganically and corresponding M&A targets are available in the market. EMSNOW & in4ma visited the Swedish factory in Malmö in November 2022.

Is it any surprise that the German Zollner Elektronik AG is still in first place? Although the company took over the American EMS company Electronic Instrumentation and Technology (EIT) LLC in July 2022, it would have been far ahead even without this acquisition and is also growing organically. With a new plant under construction in Tunisia, the competition continues to be clearly outperformed in the rear-view mirror. EMSNOW & in4ma visited HQ and the factory in Zandt in December 2021 and in4ma again in October 2022.

Perhaps you are wondering why the Prettl group is missing from this list. Considering their total sales, it certainly would belong there. However, at Prettl the EMS division is viewed separately and therefore without the other areas they cannot be included in the ranking.

Enics should also be on the list for 2022. If you observe closely, position 6 is missing in the 2022 column. And in the years before that Enics was positioned at position 3.

You will also look in vain for Asteelflash in the list. With the takeover of Asteelflash by USI in 2020, it became a non-European company and is therefore not listed. Before that, Asteelflash was at position 4. EMSNOW & in4ma visited their factories in Eberbach in December 2021 and in France in November 2022.

If we extended the list to include all EMS operating in Europe, Foxconn, Flextronics, Jabil, USI/Asteelflash, Inventec and IMI would also be among the TOP 25 and the last 6 positions would fall off the bottom. Hanza would therefore be in position 25. The question then arises as to which sales are considered for global EMS. If you only take the European sales, we will still have to wait until October 2023 before we can extract these sales from the respective countries’ company registers, as they are not reported separately in the companies’ annual reports. We would therefore have to estimate based on the previous year’s sales. In4ma conducts primary analysis and does not estimate.

If you believe we have missed any EMS companies, in4ma would be happy to receive your feedback and we can explain the evaluations to you in detail. EMSNOW & in4ma will continue to visit EMS companies in Europe in 2023 (and not just the TOP 25) and report about them.

It is not just the TOP 25 European EMS that have tested the M&A waters. It is a trend that is gaining momentum throughout the industry. You can find out more about this at the EMS forum organized by in4ma on June 21/22, 2023, in Munich. This event (in German) will be moderated by the editor-in-chief of productronic, Dipl.Ing Petra Gottwald, and is reserved for executives in the EMS and OEM industry.