Sales Outlook for December Softer but Still Growing According to ECIA’s Electronic Component Sales Trend (ECST) November 2020 Survey

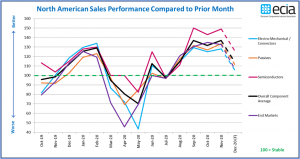

ECIA’s Electronic Component Sales Trend (ECST) monthly survey has tracked the month-to-month swings in North American electronic components sales through the unforgettable year 2020. The precipitous decline heading into the summer months followed by the dramatic rebound in the second half of the year has created a daunting challenge for participants up and down the supply chain. In measuring actual results of month-to-month sales, the resilience of electronic component sales is illustrated in the figure below. The data presented in this sales index indicate growth when the results are above 100 and declining sales below 100. From August through November, the results reported by component manufacturers, distributors, and manufacturer representatives reveal a strong and consistent growth trend. In spite of serious concerns about both supply and demand impacts in the early stages of the COVID-19 pandemic, it appears sales levels for 2020 will remain fairly stable compared to 2019 with some sectors showing relatively mild declines and others actually achieving growth.

The results reported from the most recent survey conducted in November and concluded just before Thanksgiving are encouraging despite the weaker forecast outlook for December. The December forecast for overall component sales registers at 113.9, down from a result of 136.9 in November. Even though the index declined it is still above, 100 which indicates expectations of sales growth. Multiple factors could account for the softer outlook for December. Most prominent is concern about the resurgence of the pandemic and renewed actions by government leaders to combat its spread including the renewed closure of many businesses. The economic impact from renewed quarantines and closures will be reflected across the economy, including electronics. The recent news that a bipartisan agreement in the U.S. congress may enable the passage of a new economic relief bill gives hope that some of these negative impacts can be mitigated. In addition to the continuing crisis, it should be noted that December is traditionally a weak month in the annual cycle of electronics component sales. So, the December outlook is not a complete surprise.

The index results show that the semiconductor sector has weathered the pandemic very well compared to other component markets. There were only 2 months where the semiconductor index dipped below 100 and it usually shows greater strength than other markets in the index. This relative success in semiconductor sales is illustrated by many forecasts calling for semiconductor sales growth between 4% and 5% in 2020. By comparison, sales in the electro-mechanical/connector market suffered the most during the year. In addition to seeing declines in four months of 2020, this market segment reported the lowest result of all markets with an index result of 43.4 in May. Sales trends in this market have been weaker than other component categories throughout the year.

The end market demand index has mirrored the component sales indices fairly closely throughout the year. The overall end market index has remained above 100 consistently beginning in August. All eight of the individual end markets measured in the survey moved above 100 in September and remained there through the remaining months of the year. This includes the automotive, consumer and industrial electronics markets which experienced the greatest struggles in 2020. The detailed survey results for end market growth expectations continue to reflect broad-based optimism for improving performance across all sectors.

There are still many variables that could influence future sales growth. The monthly ECST survey has proven to be a valuable barometer of current sales and helpful predictor of future sales since it was launched in October 2019. It is a complementary companion to the ongoing quarterly ECST survey. The survey has received strong and growing support by electronic component manufacturers, manufacturer reps and distributors and all participants in the electronics component supply chain are encouraged to participate in the surveys. Survey participants receive the complete results of the survey each time they provide inputs.

ECIA members can view detailed results of these monthly surveys in the “North America Electronic Component Sales Trends (ECST) report in the Stats & Insights section. This report presents data in 43 figures and 172 tables covering current sales expectations, sales outlook, product cancellations and product lead times. The data is presented at a detailed level for six major electronic component categories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.