Independence Day in Europe at EMS Conference

By Claudia Mallok

The announcement was made on LinkedIn: instead of celebrating U.S. independence day the European EMS industry was holding their 17th EMS Day in the ancient city of Wuerzburg in the region of Franconia, northern Bavaria, Germany. Nearly 100 executives from the electronics industry, OEM’s, EMS and suppliers to the industry gathered in the old location of the electronics magazine Elektronikpraxis, now a modern event venue hosting conferences and seminars for the industry.

At the event, decision makers and experts in various fields discussed how EMS companies can successfully compete in the market. Participants came from ABB Automation, Zollner Elektronik, Asteelflash, Bosch, GPV, Würth Elektronik, Lacroix Electronics, Katek SE, Melecs EWS, LPKF Laser, Rafi, Prettl Electronics and Seho Systems, just to name a few. The 36 EMS companies alone, represented more than 5.2 Billion USD in revenues (12.8%) of the European EMS production.

EMS Day is becoming more popular every year, since one of the key presentations includes detailed data about the European EMS industry, coming from in4ma statistics compiled by Dieter G. Weiss. “The EMS industry faces great challenges and opportunities,” emphasizes the author of this European EMS market Analysis.

DeiterWeiss245

“On the one hand there is great price pressure on existing products and orders; on the other hand, new technologies are also bringing new customers into the market who themselves never had their own production, but who have clear requirements in terms of products and production technologies,” explained Weiss. The structure and strategies of the European EMS companies show its strength, weaknesses, opportunities and threads. The key findings from Weiss’ report are summarized below:

- European EMS companies see much higher growth rates than OEMs as more products are being transferred and new products from startup companies are manufactured with EMS as they do not have own production. The European EMS manufacturing volume stood at 36.1 Billion Euro (40.8 Billion USD) in 2017 and first calculations show a growth of 5% to 37.9 Billion Euro (44.8 Billion USD). Growth rate in USD with 9.8% is influenced by changes in the Exchange rate.

- In Germany EMS production rose 26.8% over the last five years, the German electrical industry only 17.3%. Germany is still the biggest European EMS manufacturer with 17.6% of all European EMS production and a growth rate of 6% in 2018.

- Global Competition in Europe is mainly coming from Asian EMS, which are targeting the automotive industry. Some Asian EMS already get about 30% of their global revenues from Europe.

- Inventory levels have reached an alarming high level, more or less only due to raw material inventory piling up. In Germany inventories in average are now at 22.6% of revenues, raw materials itself at 14.9%. Some public European companies even had 16 to 17% of raw materials sitting in the shelves. This impacts net profits easily by 0.1 to 0.2%. Reasons are the allocation problems with double ordering and additional security thoughts of the buyers. One of the TOP 10 European EMS showed that it is possible to reduce inventories from 14.9% in 2017 to 14.3% in 2018 and at the same time increasing revenues.

- France, the second biggest Western European EMS country has started a program under the headline “Electronique France”, to prepare the French electronics industry for the future. In4ma explained that there is still a mismatch between the in4ma EMS numbers for France and the numbers of the French Electronics association SNESE, which has to be sorted out. According to SNESE the numbers for France should be 1.4 Billion Euro higher, which would bring the European numbers to 39.3 Billion Euro (46.4 Billion USD).

The presentation included a 26 pages essay with 28 presentation foils as a handout, so attendees could study the presentations and numbers in detail afterwards once more.

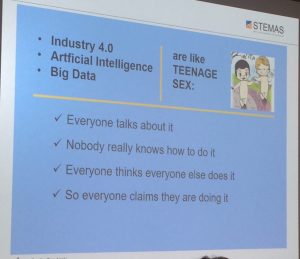

A fireworks of presentations included as well Johann Weber, CEO of Zollner Elektronik, who gave the keynote presentation this year about digitalization in the EMS industry. Michael Gasch of data4pcb explained changes in the European PCB world. Rainer Koppitz, CEO of Katek SE, now the second biggest EMS in Germany after Zollner, presented his aggressive strategy to become part of the TOP 10 EMS companies in Europe. Thomas Müsch of Stemas AG showed his strategy of combining medium sized EMS companies (Elektronikgruppe München) as a model for smaller EMS companies to be successful. Several other presentations with interesting topics completed this sparkling event.

Sufficient time for networking was scheduled at a dinner the evening before the EMS day in a superb restaurant amid the famous wine location Würzburger Stein.

The organizers Vogel Communications Group and its publisher Johann Wiesböck were delighted with the success of the new concept for the EMS day. They are thinking about extending this event and make it an international event for the European EMS industry.