Impact of the Coronavirus Pandemic on Global Capacitor, Resistor & Inductor Industries: March 2020

Originally published on TTI MarketEye Blog

By Dennis Zogbi, Paumanok Publications

Therefore, Paumanok Publications, Inc. has revised its forecasts of global revenues and volume shipments for the June 2020 quarter and the 2021 fiscal year. Paumanok notes a significant short-term negative impact on revenues, operating income, income before income taxes and net income for manufacturers of passive components and their materials vendors.

This article shows who has been affected and offers some “green shoot” paths to recovery.

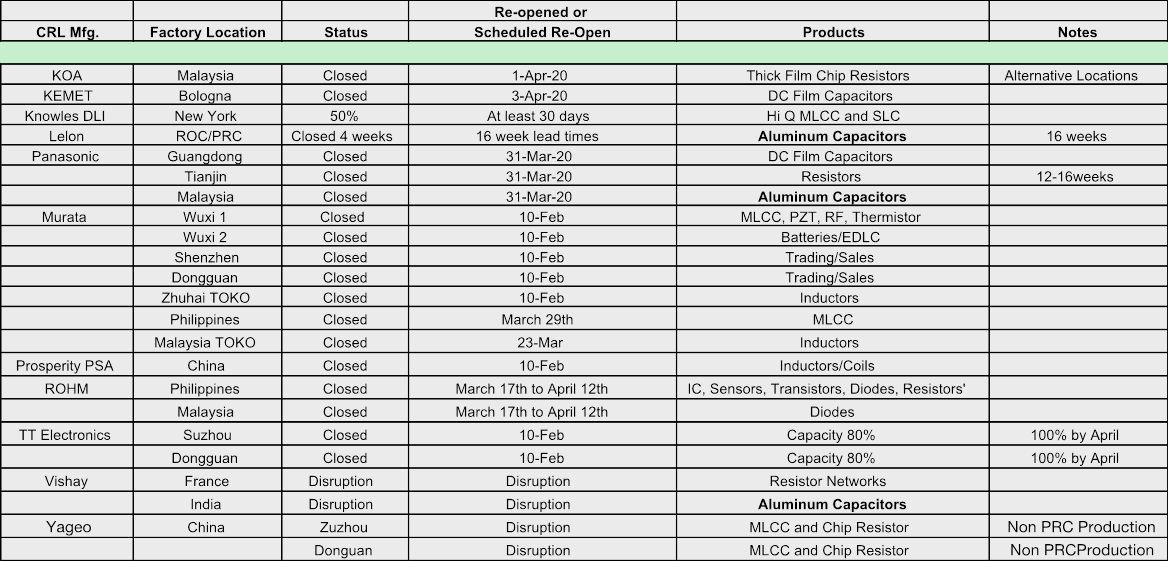

Passive Component Vendors Experiencing Disruptions in the March 2020 Quarter

The chart below (Figure 1) shows the results of a Paumanok survey designed for this MarketEYE article to establish which vendors are experiencing disruptions in the passive component industry.

The reader will note that multiple vendors and product lines are affected, although there is clearly a greater impact on the supply chains for aluminum electrolytic capacitors, DC film capacitors and discrete inductors, as well as minor impacts on MLCCs, thick film chip resistors and nichrome resistors.

Figure 1: Passive Component Vendors Experiencing Disruptions in the March 2020 Quarter

Source: Paumanok Publications, Inc. derived from vendor press releases.

The reader should note that a much wider number of vendors were surveyed; however, certain vendors have not offered their customers an indication of their status at this time. It is also important to note some other vendors’ comments: Japanese vendors and Japanese factories are not yet affected in the same degree as other regions. AVX warned in a written letter that this constituted a “Force Majeure” situation and therefore the company would direct product based upon industry and not country. CDE Electronics in the USA noted they expected short staff problems as the virus impacted the USA, but they were deemed essential to US operations and would remain open. Ohmite noted they were monitoring the situation, but their China factory for resistors was still fully operational. Walsin and Yageo both noted that their Taiwan factories were still fully operational. Korea, Taiwan and Japan seem to be setting examples of how to defeat the virus and not let it cripple the economy. They do this by isolating the outbreak after rapid identification. We now see India, Malaysia and the Philippines also adopting this approach.

Lessons Learned from the Chart Above

Most factories in China began to shut down on January 25 to coincide with a four-day national holiday, but this was extended by two weeks until February 10. After a 16-day respite, many factories began modified production at less than full capacity on February 10, but many other factories could not reopen because they did not meet local regulations regarding protective masks, suits and gloves for all employees.

The strategy for some of the component manufacturers was to seek non-PRC production solutions. Logistics, customs services and raw material supply will continue to hamper recovery until April 2020.

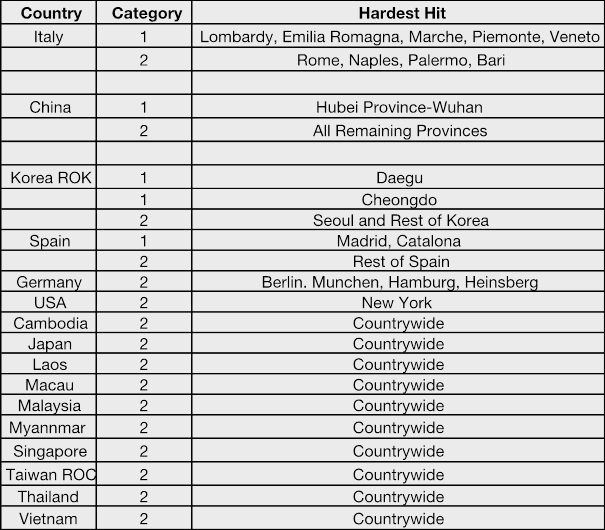

Hardest-Hit Global Regions and Cities: March 2020

Specific regions of the world by country now qualify as Category One cities and regions whereby a “stay-at-home” is mandatory due to the high number of reported cases. These include specific regions of Northern Italy, especially the towns of Lombardy, Emilia Romagna, Marche, Piemonte and Veneto where the local elderly population is known for its extreme hardiness and longevity (especially around Veneto).

All of southern Italy remains a Category Two area, with Italy near Rome, Naples, Palermo and Bari showing much fewer cases. The same can be said of the entire Hubei province of China (PRC) and the epicenter of Wuhan where the virus found its beginning.

One point of reference: comparing Figure 2 with Figure 1, we can see that the virus also impacted Dongguan based on the concentration of factories that closed because of the virus in that city, which is 1,000 kilometers away from Wuhan but is the logical freightway to ports in Hong Kong for global distribution.

The other major areas of outbreak by region include the cities of Daegu and Cheonggdo in South Korea, which are also far away from Seoul and isolated. In Spain, the regions of Madid and Catalonia have the highest concentration of reported cases; in Germany, the highest concentrations are around Berlin, München, Hamburg and Heinsberg.

In the Americas, the largest outbreak is clearly in New York City and surrounding areas. These concentrations of infected are important for the reader to understand as other countries, most notably Japan, used the data to immediately isolate any potential Category One region.

The South Koreans also imposed nationwide restrictions that worked well to save their economy after category one situations became apparent in Daegu and Cheongdo areas. The reader should also note that Malaysia, India and The Philippines also have tightened restrictions to prevent Category One events.

Figure 2: Countries and Regions Hardest Hit by the Pandemic as of March 2020

Source: Paumanok, WHO and UK Government websites. Category 1 = Stay-At-Home Order Mandatory; Category 2 = Stay-At-Home with Symptoms Only

We note from the survey from the passive component manufacturers that even though the government allowed companies to begin production in China after February 10, 2020, factories could not meet quotas because they were hampered in their complete restart through lack of personnel, raw material supply disruptions, and especially freight.

Most importantly, however, factories were competing for protective clothing for employees and local regulations required such materials be in place for all workers before machines could operate. This has created added delays and also resulted in the large-scale movement of production away from the mainland to Taiwan.

Some of the measures taken at specific passive component factories (best practices) offices include body temperature checks for all employees and visitors; face masks; and disinfection liquid for frequent handwashing provided in easily accessible places.

Impact on the Passive Component Raw Material Index

The monthly index of key raw materials consumed by the passive component industry registered a 30-day decline in price of 19 percent, with all major materials groupings consumed in the passive component space dropping substantially in price for the month.

A 32 percent drop in the bauxite/aluminum prices led the decline (this is responding to the losses realized in aviation and in the China automotive markets), followed by palladium metal, which dropped 25 percent for the month. Double-digit price declines were also noted for copper, nickel and zinc. All of these are key materials consumed in dielectrics, terminations and electrodes (for example) and their “resetting” is very similar to the reset that occurred in the 2009 correction.

Component Markets Tighten

Lead times for specific passive components saw tightening in January through March because the impact on manufacturing is exceeding the impact on end-market consumption of passive components.

We see activity in aluminum capacitors, DC film capacitors, tantalum capacitors, nichrome resistors, and axial and radial leaded inductors because these products are in the direct path of the pandemic, as shown in Figure 1. One of my major resources pointed out that there is a “push and pull” environment, with certain end-markets (such as medical technology and laboratory test equipment) that are increasing dramatically, while other markets like automobiles and aircraft have slowed substantially.

Losses Reported Due to Pandemic

Losses due to the pandemic have been reported by TDK Corporation on their website: the company has revised its sales figures downward by 2.2 percent (a very small amount for such a massive company with exposure to China). The “impairment loss” noted by TDK was for magnets and aluminum electrolytic capacitors produced by their EPCOS subsidiary.

Hardest hit was Yageo Corporation, whose production and consumption of MLCCs and thick film chip resistors largely takes place in China. The company reported revenues down 24 percent year to date. Demand remained strong in February, but the company’s capacity in China was restricted by the epidemic, which slowed the resumption of component production after the government mandated manufacturing shutdown was lifted. Walsin Technology Corporation showed a combined 29 percent drop in revenues for January and February, directly related to consumption of MLCCs and thick film chip resistors.

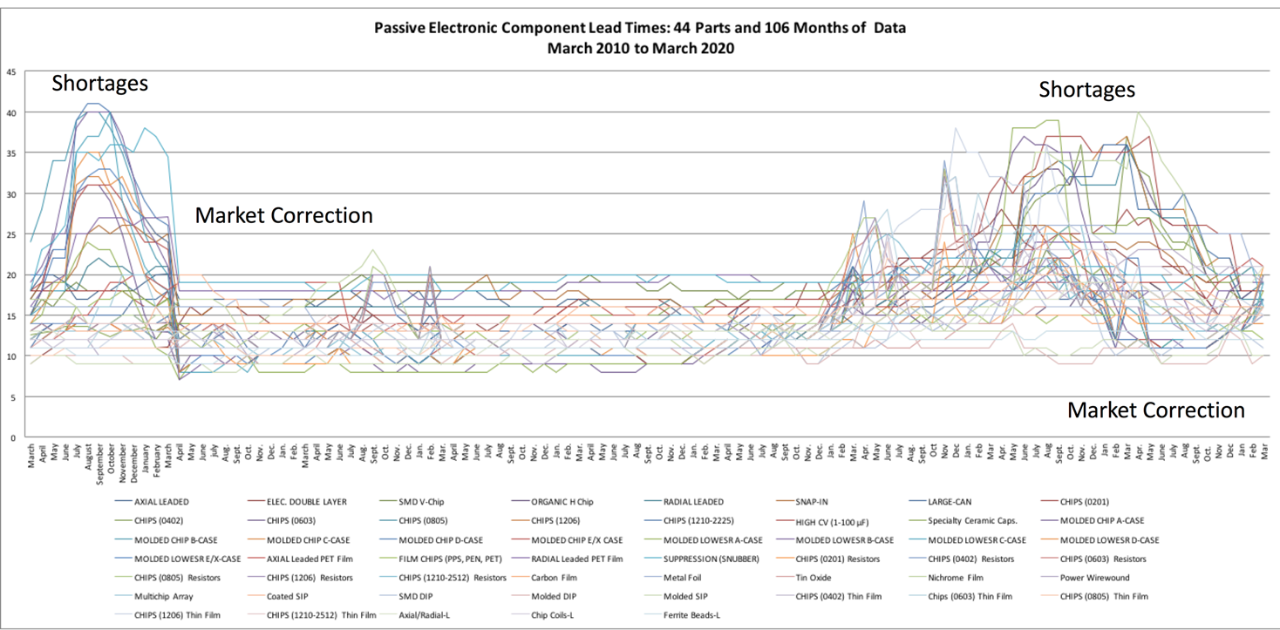

Market Conditions: Capacitors, Resistors and Inductors

The components data in Figure 3 shows lead times over the past 106 months for 44 types of passive electronic components, as compiled by Paumanok. The reader should note that the 2011 rise was stimulus-related and a third of what is being planned for FY 2021.

Figure 3: Market Correction Comparison in Passive Components

Source: Paumanok Publications, Inc.

Specific passive component supply chains have been impacted by the pandemic in the March 2020 quarter. Areas of interest and concern are where overlapping types of factories are impacted, such as is the case with DC film capacitors and aluminum electrolytic capacitors, nichrome resistors and discrete inductors.

Each of these product lines can be largely augmented by factories in Japan, or factories in other regions not yet impacted by the pandemic. We can see from the example of China that factories can get up and running faster if enough protective clothing for each worker is on hand. Raw material prices have plummeted, but component markets remain tight.

How Long Will It Take to Normalize?

The detailed answer will depend on the product, the raw materials related to that particular product, how labor intensive it is, the manufacturing location, the shipping method, and the continuity of raw material supply. Additionally, there are new variables including massive shifts in short-term demand and tooling related to passive components for respirators and additional Class II and Class III test and scan equipment.