Global Engineering Services Outsourcing Market is Projected to reach US$ 3,803.21 Billion by 2027, Reports Astute Analytica

Europe holds the highest share in the global engineering services and outsourcing market in 2021. This is because the software development services market in Europe is growing. Further, the shortage of skilled software developers and increasing demand for digital transformation is also propelling the market growth

New Delhi – The study undertaken by Astute Analytica forecasts a tremendous growth in revenue of the Global Engineering Services Outsourcing Market from US$ 1430.75 Bn in 2021 to US$ 3803.21 Bn by 2027. The market is registering a CAGR of 17.7% during the forecast period. Companies nowadays are strategically looking for new ways to reduce operating expenses to boost revenue and enhance growth. Outsourcing services help to reduce labor costs, machines, additional space, skill training, and other technology-related costs. These services prove beneficial for the company as they can invest the saved overhead cost to finance development projects and make other investments for the growth of their business. Outsourcing of business activities has become a major tool for offering productive and necessary services at other locations in a cost-effective way. Outsourcing of engineering services ensures that both knowledge and risk are substantially distributed among a network of connected companies.

Market Dynamics

The increasing trend of digitalization, automation, and robotics with use of AI and big data analysis in various industries with the integration of Industry 4.0. Further, the government investments encouraging the adoption of Industrial Internet of Things (IIoT) solutions along with rising penetration of machine learning technology in industrial sector with the help of industry 4.0 is creating a lucrative opportunistic growth for the ESO market. According to the International Data Corporation (IDC), IoT spending in the European region will surpass US$ 241 Bn by 2022. Further, Germany spends US$ 35 Bn in IoT followed by France and UK with a spending of US$ 25 Bn in IoT sector. Further, the cost of labor is often very high in developed countries, such as the US, Japan, and Germany. Hence, they prefer outsourcing their engineering services to offshore destinations, such as India, Indonesia, China, Malaysia, which can provide a favorable environment and skilled workers at a low cost. However, the loss of managerial control over connected outsourcing companies may hinder the market growth over the projection period.

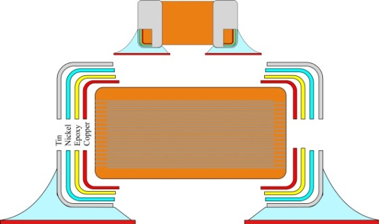

Based on type, the market is segmented into product designing, prototyping, process designing, system integration, testing, quality control, product lifecycle management and plant automation & enterprise asset management. The product designing segment holds the highest market share in 2021. This is because small businesses and new age startups with limited expertise strongly rely on outsourcing product development in emerging sectors like automotive and electronics which is a key factor for the growth of segment.

Location Insights:

Based on location, the market is segmented into onsite, on shore, and offshore locations. Among these, the offshore segment holds the highest market share of 49% in 2021. Labor cost is very high in developed countries; hence companies prefer outsourcing segments to offshore destinations. Further, the rising demand of engineering services from the automotive sector will fuel the market growth during the forecast period. However, the on-site segment has the highest annual growth rate during forecast period, as companies are increasingly focusing on the continuous upgradation of their engineering capabilities to reduce time and improve efficiency.

Pricing Model Insights:

Based on pricing model, the Global Engineering Services Outsourcing Market is categorized into staff augmentation, time and material, fixed price projects, services, and risk/rewards. Staff augmentation segment dominates the market in 2021. However, the risk/reward segment holds the highest CAGR over the forecast period. This is because the client and service provider generally share funding development of new products allowing partner to share rewards. Assigning responsibilities to the partner mitigates some risks associated with new processes, technology, or models.

Industrial Insights:

In terms of industry, the market is segmented into aerospace, automotive, computing systems, construction, consumer electronics, energy, machinery, healthcare, industrial, medical devices, semiconductors, telecom, and others. Among these, the telecom industry holds the highest market share in 2021. Increase in wireless communication, which is a fast-growing sector, and using mobile with cloud-based technology is driving the segmental growth. However, the medical devices segment holds the highest CAGR during the forecast period.

Regional Insights:

Europe holds the highest share in the global engineering services and outsourcing market in 2021. This is because the software development services market in Europe is growing. Further, the shortage of skilled software developers and increasing demand for digital transformation is also propelling the market growth. However, the Asia Pacific engineering services and outsourcing market is projected to growth at the highest annual growth rate of 19.9% owing to the emerging local outsourcing demand, strong manufacturing base, and cost arbitrage in developing countries such as China and India.

Impact of COVID-19

The impact of the outbreak of the COVID-19 pandemic and the subsequent lockdowns in various countries across the world on the engineering services and outsourcing market varied depending on the end-use industries and industry verticals. Various industrial facilities, manufacturing plants, and public transport were shut down temporarily as part of the efforts to control the spread of the disease. Further, the automotive and construction sectors witnessed a fall in demand, which further pulled the market backward. However, the market is expected to grow positively during the forecast period as economies are slowly recovering in the post-pandemic period.