EMSNOW Executive Interview: Jeffrey T. Schlarbaum, President & CEO, IEC Electronics

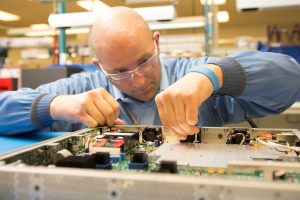

IEC Electronics specializes in providing manufacturing services for advanced technology companies whose products are highly complex and must conform to the industry’s highest levels of quality and reliability. The company has opted to locate all three of its manufacturing facilities in the U.S. We caught up with IEC’s CEO Jeffrey Schlarbaum to learn more about this strategy to specialize in these products with this geographic footprint.

EMSNOW: You are currently in your second go-around at the head of IEC Electronics. What is it about this industry and this company that has you so engaged?

EMSNOW:IEC seems to focus primarily on markets with highly complex products like medical, aero/defense, and industrial. What is it about those market sectors that is especially appealing? What sub-sectors of other markets would also be attractive to you?

EMSNOW: Your current geographic footprint includes three facilities all in the United States. Is your plan to maintain this U.S. focus, or are you receiving any customer requests to expand to possibly include a low-cost region?

EMSNOW: What impact are component shortages and tariff issues having on your business and how are you responding to these issues?

The impact of the component shortages has been similar to other companies, both EMS and OEMS experiencing longer lead times, supplier reschedules, and even unexpected order reductions and cancellations. While there have been some lead time improvements occurring within the industry, as a whole, it has primarily benefited the higher volume commercial component markets. For companies like ours operating in highly regulated, lower volume markets, we continue to see source of supply challenges. Having said this, we continue to work with our customers to identify acceptable alternate component manufacturers, secure non-franchised broker inventory, and overall better demand plan so we can proactively drive the supply chain ahead of production demands. While we can’t control the component industry, we will continue to develop customized approaches for our customers to overcome the current supply constraints and position them for success with their end customers. In terms of tariffs, the short answer is yes, they’ve impacted our business. However, since we manufacture and distribute solely from the US, the tariff impact is isolated to raw material receipts from China which represent a much smaller percentage of our total raw material receipts.

EMSNOW:Some semiconductor and component analysts are forecasting a slowdown for the rest of this year, but recovery in 2020. Is this consistent with IEC’s business outlook?

No, we’ve delivered four consecutive quarters of increased revenue growth and our current outlook remains positive. In fact, over the last six fiscal quarters, we’ve experienced record bookings resulting in an aggregate book-to-bill ratio of 1.6:1 which has driven our backlog levels to record highs. To put things into perspective, we began our current fiscal year with a backlog level that had grown by 85% over the prior fiscal year. Now just three quarters in to the current year, our backlog is up another 60% so best we can see, both our near term and longer term views remain strong.

EMSNOW: The EMS industry is a crowded field of competitors. How do you plan to differentiate IEC in this industry?

I believe, first and foremost, our differentiation stems from our unique approach of exclusively focusing on mission critical and life-saving products. The electronics industry is broad and there are many competing offerings for companies looking to outsource their manufacturing. However, by focusing on highly targeted sectors of the market, it enables us to establish a uniquely differentiated position when compared to the vast majority of the industry. In terms of differentiated capabilities, it’s a combination of a vertical integration, scientific laboratories, and 100% US based manufacturing. As a result of our vertical integration, we control the cost, quality and lead-time for the critical commodities specified by our customers without having to rely on third party sources. As it relates to our laboratory services, for example, we’re the only EMS provider in the industry with an in-house lab certified by the Defense Logistics Agency (DLA) to perform MIL-STD-202 testing. Once again, rather than rely on third parties, we can perform the requisite testing in-house to ensure military-grade components meet the government standards for use in the manufacturing of their products, ultimately collapsing lead-times and reducing risks. Lastly, as I mentioned previously, our deliberate commitment to 100% US manufacturing supports our customer’s interests emphasizing a commitment to extremely high quality standards while providing the highest levels of customer service and support.

EMSNOW: Please tell us about IEC’s Analysis & Testing lab and how this is a differentiator for you?

Our Analysis and Testing laboratory performs forensic style investigations of electronic components for root-cause analysis or counterfeit component detection to mitigate risk. As previously stated, we are the only EMS with an on-site lab approved by the Defense Logistics Agency (DLA) for their qualified testing supplier list (QTSL), which means we are a pre-qualified source for certain electronic components and have demonstrated accepted counterfeit mitigation practices and quality assurance procedures consistent with industry quality standards. We recently expanded our services with the DLA to include MIL-STD-202 testing which allows us to seamlessly test and transfer parts into the manufacturing, whereas before we had to outsource that testing, hence now saving time and money for our customers.

EMSNOW: What are the biggest challenges to profitability that your company faces? How are you addressing these?

Our primary profitability drivers are a combination of raw materials, direct labor, operational overhead and capital investments necessary to transform raw materials in to finished products. An often overlooked factor also involves the robustness of the product design we’re tasked with manufacturing. Understanding the “ready for primetime” nature of the product design prior to introducing it in to manufacturing and then precisely documenting the scope of work the customer is asking us to perform is a critical factor to ensure services are priced appropriately and cost overruns are mitigated.

During the transformation process from raw material to finished product, the two most significant influences to our profitability are the actual raw materials we acquire and our workforce. On the raw material side, as we have previously discussed, the cost and lead time uncertainties more recently imposed by the industry cause challenges to the overall production planning and scheduling to ensure an efficient execution of the manufacturing process. Also, component price inflation is another risk that must be rigorously managed. At the same time, we regularly invest to automate the various facets of the manufacturing process, but there are always critical functions that must be performed by highly skilled operators. With our recent growth over this past fiscal year, over our first nine months, we have increased our workforce by over 160 employees. It’s a non-trivial investment to recruit, onboard, train and retain a highly effective workforce so the manner in which we do this commands a great deal of attention to ensure it’s done right and supports our profitability objectives.

EMSNOW:What do you see as the EMS industry’s greatest challenges in the next 1-2 years?

As an EMS provider, our customers rely on us for expertise to execute the process. One challenge for EMS providers is that as they commit to ascend the value chain ladder to expand relationships with their customer, including advanced technology and product development, there becomes a risk that they could eventually begin to compete with the very customers they are committed to support. At IEC, while we do have certain value added services, we understand that our customers are the experts in their own end markets and we compliment their expertise with our own. EMS providers that chose to venture further into the areas their OEM customers consider their own core capabilities, confront a delicate balance to their role as a supplier versus a potential competitor.

EMSNOW:What do you see as the EMS industry’s strengths going forward?

One of the key strengths of the EMS industry is the ability to change at a rapid rate with regards to markets and technology. If we look the last 5-10 years and how rapidly technology has changed within the electronics marketplace, the EMS industry has responded in a proactive manner to meet the demands of its customers and evolve just as quickly. Whether it is technology investment, flexible workforce management, or working capital support, the EMS industry has become an important tool for many Fortune 500 companies and lesser known companies alike who realize that there are manufacturing experts that can better support their strategic customer growth initiatives by managing the manufacturing demands while the OEM’s themselves focus on product innovations and customer care.

EMSNOW:Are these aligned with the challenges the industry faces?

Yes, as the OEM industry continues to develop their general manufacturing strategy, the balance between in-house manufacturing versus partnership with an EMS will always need to be evaluated in terms of make versus buy from a financial, but also risk mitigation perspective.

EMSNOW:Is there anything else about IEC that you would like to share with the EMSNOW readers?

We are very excited of have just broken ground on a new state-of-the-art facility, which will be located near our current headquarters in Newark, NY. Constructing this new building enables us to design, from the ground up, a state-of-the-art, advanced technology facility that can support our growth as a provider of electronic manufacturing design and production services for life-saving and mission critical products. We anticipate moving into the new facility in the summer of 2020.