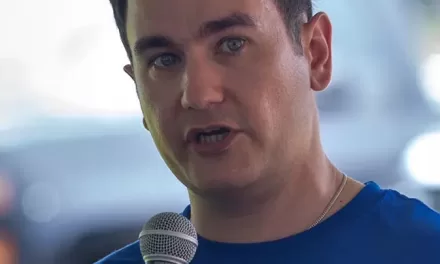

EMSNOW Executive Interview: Don Charron Kimball Electronics

EMSNOW: Kimball has an interesting corporate history starting as a manufacturer of electronic organs and then beginning its contract manufacturing business as a supplier to GE Appliances in the late 1960’s. How has that history shaped and influenced the company today?

Contract manufacturing has been in our DNA from the very beginning. It didn’t matter whether or not we were making something for a sister division or an outside company, the same service excellence mentality applied. Our strong company culture has always been the cornerstone of our strategic plans. Formed and shaped by our Guiding Principles, our company culture and core values derive from our basic, but very important beliefs:

- Our customer is our business.

- Our people are the company.

- The environment is our home.

- Profits are the ultimate measure of success.

Living by our Guiding Principles helps keep our global team aligned with, focused on, and committed to meeting and exceeding the expectations of all our stakeholders. Without such a strong company culture and a focus on lasting relationships, our journey would not have been possible.

EMSNOW: The automotive, medical and industrial verticals regularly account for about 90% of Kimball revenues. How do you see business in those sectors evolving in the next 12-18 months?

The macro trends that support these end markets are pretty compelling and exciting. Electrification and self-driving will accelerate increases in the electronic content per vehicle. The aging population and growing number of people in the world that can afford better healthcare are significant factors in the growth story for medical and investments in technologies such as “connected health” to improve patient outcomes could be an even bigger part of that story in the future. Energy efficiency is a large driver in the industrial space.

EMSNOW: Congratulations on the recent acquisition of GES. How will this acquisition strengthen Kimball in its current markets and help you possibly expand into others?

When closed, the GES acquisition will be a major step in our new platform strategy and our plans to continue our development beyond EMS to a multifaceted manufacturing solutions company. GES will help us open new doors to new customers for future growth in sales and profit. Automation, test, and measurement are interesting growth areas and having capabilities in these areas can help us become a better manufacturing company too.

EMSNOW: Kimball is on track to cracking the $1B per year revenue mark. What strategic challenges and opportunities does this pose for you?

After reporting our Q3FY18 sales in May, our trailing twelve month sales are now over the $1 billion mark for the first time. Achieving this long time publically stated goal in FY18 will be very gratifying for our entire global team. Getting to $1 billion will give us the size and scale needed to remain financially solid and increasingly relevant to the multi-national customers that we serve. Of course, challenges of alignment and customer focus can occur as an organization grows around the globe, but we feel our Guiding Principles translate well to keep us aligned in all of the countries where our operations are located.

EMSNOW: Kimball has a manufacturing footprint in most major global regions. How do you view the outlook for the global EMS market over the next 2 years?

Kimball Electronics Romania Manufacturing

We have been enjoying a pretty good run of global, synchronized growth and that certainly has a good chance to continue over the next 2 years. I think we need to keep an eye on the trade talks, the growing European Union skepticism, and other disruptive forces that could impact the world economy and overall market demand.

EMSNOW: Where do you see future growth opportunities for the industry?

I think that when it comes to traditional EMS, we’re definitely on the other side of the rapid growth years and future growth rates will more likely be closer to the GDP’s of the various economic regions. Non-traditional EMS will likely continue to provide interesting growth opportunities.

EMSNOW: What issues do you expect to be the most challenging for Kimball and the EMS industry over the next few years, whether it be technical, geopolitical, human resources, etc.? How can companies like Kimball best prepare themselves to deal with these issues?

For the near term, the component shortage issues will likely persist through 2019 and that will put a lot of pressure on us as an industry. It will be important for us to work closely with our customers and suppliers in order to provide as much visibility as we can when it comes to demand planning. Longer term, I think the talent shortage that we are already facing today will be an even bigger issue in the future. I’m not just talking about the shop floor; I’m talking about all job categories. Manufacturing has lost a bit of its allure as it relates to career selection of the new entrants into the workforce and we are losing significant talent and organizational knowledge to retirement. We need to rebuild talent pipelines and establish new ones. We need to reinvigorate the base and attract new talent. While I have always considered EMS to be the “blue collar” of “Tech”, I still believe that it provides a great opportunity for an exciting and challenging career.

EMSNOW: Many EMS companies have pursued higher profitability by both expanding into non-traditional EMS services and by investing in improved efficiencies. What is Kimball doing in this regard?

We’re doing both. We have specific initiatives that are aimed at optimizing and strengthening our core EMS and DCMS (Diversified Contract Manufacturing Services – no PCBA and/or not PCBA centric) business. We plan to follow our People Strategy and leverage our software investments in Workday and Ariba as part of our Industry 4.0 strategy to drive improvements in enterprise productivity. As I stated earlier, our pending acquisition of GES is just the first step in our new platforms strategy.

EMSNOW: Is there anything else you would like to say to EMSNOW readers?

Our Environmental, Social and Governance (ESG) strategies and programs are very important to our success. I am really proud of our global family and how our teams around the world are finding meaningful ways to give back to the communities we live and work in. This aligns with our focus of building success wherever we go in the world. Corporate Social Responsibility or “Citizenship” as we refer to it in our Guiding Principles has been and always will be a key part of who we are. To us, it’s simply doing the right thing.