EDDI and I – When the Numbers and the Chatter Agree

Philip Spagnoli Stoten is the Founder of SCOOP

By Philip Spagnoli Stoten, with insights from Georg Steinberger, Chairman of the FBDi e.V (Professional Association of Component Distribution)

Sometimes it seems that the statistics are at odds with what you are hearing in the industry, in conversations, in interviews and panels, and on LinkedIn. That’s not the case here! For once, the numbers and the chatter seem aligned. And the good news is that both indicate an easing in the supply chain shortages we’ve struggled with in 2021 and the first half of 2022.

We’re not out of the woods yet, but it feels like we’re closer. One EMS VP of Operations told me last week it was like “night and day”, with a huge easing of the shortages they’d seen, shorter lead times on new orders and an all round easing. As he explained, this is good for customer satisfaction, good for business morale, and of course good for cash flow as product ships, inventory is reduced and working capital requirements are reduced.

As always, my starting point is two-fold. Firstly, I am listening to what those on the front line are saying when asked directly. And secondly I am reviewing the data provided in this month’s EDDI (Electronics Design to Delivery Index) provided free of charge by those kind people at Nexar, an Altium business unit, bringing insights for millions of electronic components and millions of daily user interactions across design, supply chain, and manufacturing. I’m a huge fan of this report and the mix of highlight trends and deep-dive data it provides.

So, what’s cooking this month?

Let’s start with the supply side:

- The Industry Supply Index continued its year-long increasing trend, rising six points and nearing its most recent high of 99 observed in November 2020.

- The increase in the ISI (Industry Supply Index) was led by supply increases in all commodity categories. The Supply Index for Integrated Circuits saw the largest increase of eight points. This is the second straight month of supply increase in this category.

- Three other commodity categories (Power Products, Passive Components, and Circuit Protection) continued to exceed their prior all-time highs.

On the demand side:

- The Industry Demand Index decreased by four points in July 2022 to a value of 155.

- Sourcing activity for all categories decreased, except for Connectors and Circuit Protection.

- The index for Integrated Circuits continued to fall substantially by 16 points. Activity in this category remains the highest of all commodity subcategories, but the index has fallen by 12.7% from its February 2022 all-time high.

- Discrete Semiconductors continues to be the category with the second highest demand index value over the past 12 months.

EDDI divides integrated circuits into dozens of different categories, highlighting five. All rose in supply in July, while the sourcing activity for the same five categories all fell. They are still out of balance, but they’re moving in the right direction.

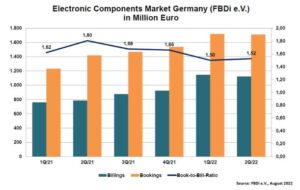

Georg comments, “A brilliant second quarter of 2022 continues to allow the German component distribution industry to dream of a ‘record’ year. The turnover of the distributors reporting in the FBDi grew by 43% to €1.12billion, incoming orders increased at least by 21% to €1.71billion, almost as high as in Q1. Although the book-to-bill rate could not reach the absolute record level of last year, it still remains above ‘normal’ at 1.52.

“What is most surprising about the second quarter is the fact that bookings have so far remained drastically above a healthy level,” he added. “Traditionally, the market starts to talk about shortages at a book-to-bill rate of 1.2, and we have remained above 1.5 since the beginning of 2021 (six straight quarters). Looking at it in a more differentiated way, you can already see normalization tendencies in almost all product areas outside of semiconductor components. What this means for the rest of the year or for next year is open to speculation – bets are already out on a slowdown as early as this year or a continuing structural shortage in individual product segments until next year.”

Thanks Georg, some answers, but plenty more questions!

Not out of the woods yet!

Let’s not get too excited, there are plenty of parts in short supply still and EMS companies are still enduring record levels of inventory and work-in-progress, as well as the subsequent cash flow issues that follow. Some are also still very concerned about the potential for the cancellation of over orders or double orders placed by customers. As we know OEM demand forecasts are notoriously unreliable, why should their orders be any different?

All in all, it feels like good news. But we’re used to disruption now, so expect more! Expect supply chain instability to continue well into 2023. Expect geopolitics to continue to impact the industry in many parts of the world. Expect brands to look to de-risk their supply chains where they can. Basically, expect disruption, even embrace it and roll with the punches!

That’s it for this month’s “EDDI and I” update. More when the August numbers drop in a month or so. If you want to get the report when I get it, just follow this link.