ECIA Member Survey on COVID-19 Response

Coronavirus Survey, Update 4, Results of Manufacturer & Distributor Survey Ended Apr 6, 2020

ECIA Members can gain access to the full report at www.ecianow.org

By Dale Ford, ECIA Chief Analyst

Dale Ford

With the spread of the Coronavirus / COVID-19 around the world there is a need to provide visibility on how this crisis is impacting the electronics components industry and the supply chain. (See Figure 1) In order to provide important visibility, ECIA has been conducting surveys of member manufacturing and distributor companies to gain an understanding of this fluid situation. ECIA published the results of the first survey which ended February 7, 2020 in a report released on February 11th. This was followed by three more surveys that concluded February 21, 2020, March 6, 2020 and March 20th.

This most recent survey was conducted between Monday, March 30th and Monday, April 6th. Between the most recent survey and the previous survey that ended March 20th the number of confirmed cases and deaths due to COVID-19 jumped by four to five times worldwide. More stringent quarantine orders have been implemented and new U.S. weekly unemployment claims have smashed records as the economic impact of the pandemic sweeps around the world. A sense of urgency to reopen the economy is building and the U.S. government approved an unprecedented stimulus package to try to rescue a wide range of industries and businesses.

The survey ended March 20th had pointed to brightening expectations for easing pressure on the electronics component supply chain. However, this most recent survey reflects the deepening worldwide crisis and presents renewed concerns for the impact on the electronics markets and supply chains. The number of respondents seeing a severe impact on the electronics components supply chain jumped from 2% to 8% between the previous and most recent survey. However, the number seeing an impact ranging between moderate to severe remained constant at approximately 80% of respondents. The area of greatest concern is the loss of end-market demand with the Automotive and Industrial Electronics markets continuing to represent the segments of greatest concern.

The degree of uncertainty surrounding the continued spread of the virus and its impact on economies continues to grow and is reflected in the ongoing volatility in the financial markets. Governments around the world continue to combat this pandemic with daily reports on patients, deaths, scientific initiatives, medical equipment/supply production, public protection orders, economic repair legislation, etc. If there is sufficient need, demand and support, ECIA will conduct additional surveys at an appropriate time. ECIA members are encouraged to support these surveys in order to enhance industry understanding of impact of the Coronavirus / COVID-19 on the electronics components supply chain.

The full report provides detailed data by component type for the major categories of:

· Electro-Mechanical

· Passives

· Semiconductors

Market and Supply Chain Impact

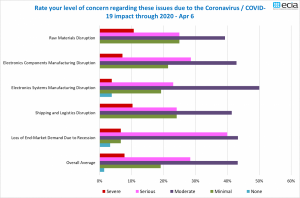

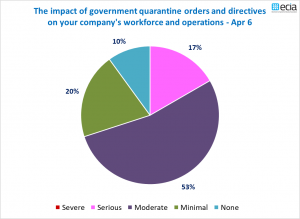

The latest results showed a surprising increase in the number expecting no change to end-market demand due to the pandemic. No expected change was the most common response for those able to report in four out of seven market segments. Automotive and Industrial Electronics continue to generate high levels of concern about lost market demand. As anticipated, Medical Electronics demand is expected to see a strong increase. While there was a notable growth in the number expecting severe disruption in the supply chain, the latest survey also saw a major shift from serious to only moderate concern regarding supply chain disruption. This new survey added a question about the impact of government quarantine orders and directives on a company’s workforce and operations. Moderate disruption was reported by 53% of participants and 17% indicated a serious disruption.

Supply Chain Issues

Source: ECIA

Operations and Workforce Impact

Source: ECIA

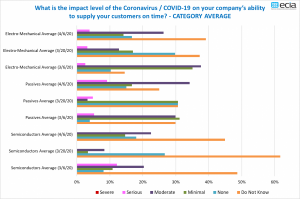

Top Level Averages

Survey results showed a jump in those seeing a moderate disruption to the electronics components supply chain in all three segments of Electromechanical, Passive and Semiconductor components. The Passive component segment saw a notable increase in those seeing a serious disruption and also recorded its highest level of those expecting a moderate disruption. Most respondents reporting visibility expect the impact of the crisis on the supply chain to extend out to June and July or beyond in all major segments. In addition, expected lead teams are now expected to grow to three weeks and beyond in most cases. The largest number of survey participants still report that they do not know what to expect in terms of impact, duration or lead times. Semiconductor participants still have the greatest challenge in their ability to assess the impact level of the Coronavirus.

Analysis of the survey results points to the need for continued research as companies continue to improve their understanding of how the Coronavirus is/will impact their supply chains.

On Time Supply Impact

Source: ECIA