Staffing Chip Fabs – Strategies for Success

Since last year’s adoption of the CHIPS and Science Act, aimed at bringing chip manufacturing back to the U.S. shores, global semiconductor companies have announced a plethora of new U.S. greenfield fab builds worth billions of dollars. This is great news for the nation, but one that comes with a sizeable challenge – where will the industry find the estimated 50,000 qualified workers needed to staff these new plants? When it comes to the global skilled labor shortage in the semiconductor industry, there is no one-size-fits-all solution. Several measures, when combined, could augment human capital retention in our fabs, fill up the talent pipeline, and accelerate the recruitment of skilled workers over the coming months.

Preserving existing semiconductor jobs at all cost

Tackling the global skilled labor shortage should start with preserving current semiconductor jobs in our legacy fabs. Some chipmakers already incorporate fab workforce retention as an integral part of their manufacturing strategy. It is no coincidence that Texas Instruments (TI) purchased Micron’s operational 300mm fab in Lehi, UT in February last year and that they chose to build another new 300mm fab next to the existing campus. TI saw the great strategic advantage of immediately rehiring all of the fab’s 1,215 highly skilled employees.

Leveraging technology

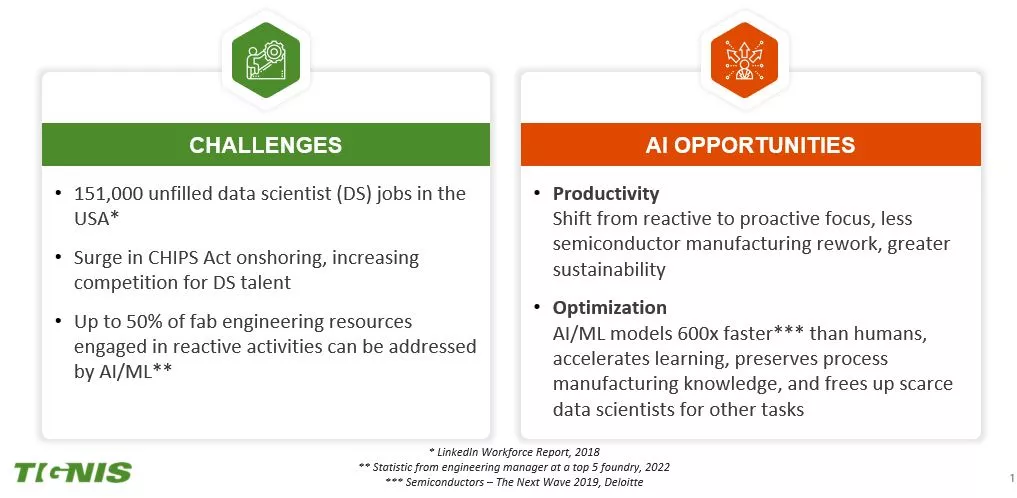

Some U.S. companies are doing their part to help solve the skilled labor shortage by deploying artificial intelligence (AI)/machine learning (ML) solutions in wafer fabs. For example, Seattle, WA-based Tignis has improved productivity and reduces talent risk with regards to data scientists who are few and far between on the market. “One benefit many fabs don’t immediately realize is how AI/ML can positively impact their operations beyond the advanced data analytics they provide,” explains David Park, Vice President of Marketing for the company.

“When implemented in high-volume manufacturing environments, AI/ML models can reduce the repetitive workload of a company’s data scientists, leading to higher job satisfaction and job retention,” Park added. “We also see AI/ML models being used to democratize institutional knowledge in semiconductor manufacturing. AI/ML models not only provide expert-level decision-making 24/7 across global operations, but the models also become blueprints that others can learn from as they mature in their data science roles within the organization.”

Training the next generation of semiconductor workers

For the CHIPS Act to succeed, wafer fabs will need thousands of skilled workers and U.S. engineering schools are now racing to build the talent pipeline. Universities and community colleges are revamping their semiconductor-related curricula and forging strategic partnerships with one another as well as key industry players to train the staff needed to work in future U.S. semiconductor manufacturing facilities.

This year, Purdue will kick off a new program aimed at educating workers for SkyWater. Supported by state and regional economic development organizations, the program will include operator and technician training through associate degree courses at partner Ivy Tech Community College.

Strengthening diversity and inclusion

According to a 2020 study conducted by McKinsey and Co., businesses that increase diversity and inclusion in the workplace have 19% higher innovation revenues, maintain a 35% performance advantage over their homogenous counterparts, and are 36% more profitable. A great success is Intel’s launch of its Supplier Diversity and Inclusion program in 2015. Three years ago, the company announced its goal to increase global annual spending with diverse suppliers to $2 billion by 2030. On May 11, 2023, Intel announced it reached $2.2 billion in diverse supplier spending in 2022, eight years ahead of schedule, representing nearly 15 times the annual total and double its 2019 results. The company met two more goals early – $250 million in spending with U.S. black-owned suppliers by the end of 2023 and $800 million in spending annually with minority-owned suppliers globally by the end of 2023.

The U.S. CHIPS Act encourages chipmakers to develop programs that will attract more women to the semiconductor workforce by including affordable, high-quality childcare. The SEMI Foundation, the non-profit arm of SEMI, recently created Chip In!, a documentary that aired on PBS in April to entice more people to consider careers in microelectronics.

As a global industry, we need to make human capital retention in fab transfers a priority and continue to make the semiconductor industry a more attractive career option for many different demographics. By coming together and acting on multiple fronts simultaneously, we can make a real difference in curbing the current skilled workforce shortage in our fabs and staff those high-paying technical jobs in the near future.

About the Author

Prior to founding ATREG, Stephen established Colliers International’s Global Corporate Services initiative and headed the company’s U.S. division based in Seattle, Wash. Before that, he worked as Director for Savills International commercial real estate brokerage in London, UK, also serving on the UK-listed property company’s international board. He also spent four years near Paris, France working for an international NGO. Stephen holds an MA degree in Political Theology from the University of Hull, UK and a BA degree in Business Commerce from the University of Washington in Seattle.