New Venture Research Publishes Annual EMS Report

Nevada City, California – New Venture Research (NVR) announces the publication of its annual electronics manufacturing services report, The Worldwide Electronics Manufacturing Services Market – 2023 Edition.

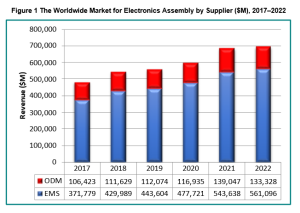

The worldwide contract manufacturing (CM) market expanded at a rapid pace of percent CAGR over the last five years, averaging a 7.7 percent CAGR. However, in 2022 the year-over-year growth rate went flat from the previous year and decreased from 14.8 percent to 1.7 percent—the lowest growth seen over the last five-year period. Nevertheless, the industry reached a new all-time high of $694.4 billion in 2022, mostly led by top-tier EMS companies. EMS companies averaged the highest growth over the last five years, exhibiting an 8.6 percent CAGR, whereas ODMs experienced a somewhat lower growth of 4.6 percent. Both suppliers were hurt by a slump in PCs and smartphones which experienced an overstock situation from the surge of the previous year. Figure 1 shows revenue by supplier for 2017–2022.

The CM market was sustained by the strong demand in the automotive, aerospace/military, and medical markets. Orders for tablets, desktop and notebook computers, and servers, once strong, weakened in 2022 as demand for replacement sales had peaked in the previous year. Desktop revenue is now expected to be in decline for the next five years, while notebook orders should remain strong. The computer industry as a whole (which includes servers and workstations) will see good growth over the next five years. Some of the highest growth rates for electronics assembly products were found in the medical and industrial markets. The pandemic negatively affected the transportation sector (automotive and aerospace), as well as certain consumer electronics products, due to a decline in disposable income but transportation has since recovered. Nearly all the high-mix/high-complexity products (medical, industrial, transportation) experienced higher than average growth, except for defense/military projects, which were flat, according to our surveys, as contractors attempted to determine if any new investment upgrades would be forthcoming from the US government.

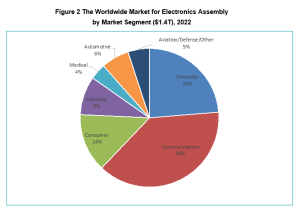

Figure 2 summarizes the worldwide assembly market for all electronics products for 2022 by market segment. The largest market in size is the communications segment, with its dominance by smartphones that have begun to overshadow the computer market. The computer market will always see growth driven by upgrades and new developments such as generative AI that will be demanding more compute power and storage. The consumer market ranks third and is sustained by strong demand for digital TVs. The industrial market ranks fourth in size, followed by the automotive and aviation/defense/other transportation segments, and lastly by the medical equipment market. Together these market segments for electronics product assembly totaled approximately $1.4 trillion in assembly revenue. Figure 2 illustrates these costs by percentage for 2022.

Communications and automotive products will continue to be the segments driving the largest growth in the electronics industry. In 2027, the total industry is expected to reach nearly $1.8 trillion in annual assembly value (COGS), as consumption and replacement of electronics products continue and new products fuel demand. Outsourcing has become a critical element in keeping the electronics assembly industry expanding and driving costs to the margin each year—a leading factor in stimulating continuous consumer demand. The trend to move price-sensitive manufacturing to low-cost regions will impact the industry for all suppliers in the foreseeable future.

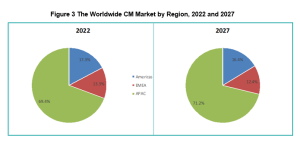

Figure 3 compares the worldwide CM market by region for 2022 and 2027. The shift in production to low-cost regions has been largely accomplished, although some migration will continue unless tariff impositions impede the market. Today, we are seeing OEM customers insisting that their CM partners manufacture products near the regions where the products are to be sold. For certain high-volume products like smartphones and PCs, OEMs need to leverage the lowest cost in manufacturing; however, labor cost differentials are becoming less significant when weighed against the total cost of production (such as transportation and logistical challenges). The shift toward Asian manufacturing is expected to continue, with both the Americas and the EMEA regions’ percentages diminishing slightly by 2027.

Figure 4 compares the worldwide CM market by industry segment for 2022 and 2027. Both EMS firms and ODMs will experience the strongest growth from production in the communications market segment. Specifically, EMS companies will find good growth in medical and industrial products, while ODMs are projected to experience good growth in cellular servers, storage systems, and smart home, wearable, and AV equipment.

In general, EMS firms will tend to excel in technology-intensive product areas and in complex, low-volume board assemblies. ODMs excel in manufacturing commodity/high-volume products such as motherboards, monitors, handhelds, and consumer electronics.

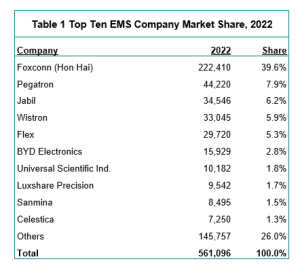

Table 1 ranks the top ten EMS companies by revenue for 2022. Foxconn continued its extraordinary dominance as the leading EMS firm in the industry, outdistancing its closest contender by more than five times. The top ten leaders accounted for 74.0 percent of total industry revenue.